Executive Summery:

• S&P 500 declines 1.64% to 6,729 as AI stocks pull back and government shutdown exceeds 40 days

• Third quarter earnings season continues to exceed expectations with 82% of companies beating EPS estimates

• Nvidia experiences sharp pullback following CEO comments about China's AI capabilities

• Government shutdown now longest in US history, creating data blackout and disrupting air travel

• Market sentiment indicators suggest potential year-end rally based on historical guidance patterns

Previous Week:

Equity Market Performance

Markets faced significant pressure last week as the S&P 500 closed down 1.64% at 6,729. The AI trade continued its pullback amid ongoing earnings reports and the historic government shutdown. The index broke below the 6,800 level early in the week, reaching long-term upward trending channel support at 6,725 on November 6th before declining further to 6,630 on November 7th.

The selloff intensified following comments from Nvidia CEO Jensen Huang, who suggested China is positioned to win the AI race against the United States. This triggered a massive market reaction, with Nvidia erasing close to $800 billion in market value over five days. Names like Nvidia and Meta approached 20% declines from their record highs set just days prior to the pullback.

Despite the day-to-day volatility, many of these swings appear to represent noise rather than material shifts in the outlook for the AI Revolution. After an exceptionally strong run since the April 2025 bottom, large-cap technology stocks that have led the market higher appear to be taking a breather. Technical indicators showed the daily RSI bouncing off approximately 40 support, with the daily bottom Bollinger Band shifting higher to 6,588.

The index remains above its 6,550 higher low from October 10th, suggesting the most recent higher low is currently being formed. We believe this dip will ultimately be bought and will set the stage for another push back into record high territory.

Corporate Earnings Season

Third quarter 2025 earnings season continued to deliver strong results. With 91% of S&P 500 companies now having reported, 82% exceeded EPS expectations while 77% beat revenue estimates. The blended earnings growth rate for Q3 2025 currently stands at 13.1%, significantly above initial expectations of 7.9%.

However, the outlook for Q4 2025 appears more cautious. A total of 42 S&P 500 companies issued negative EPS guidance compared to 31 companies providing positive guidance. This represents an important shift in sentiment as companies assess the economic environment heading into year-end.

An interesting pattern emerged where companies reporting positive results received mixed market reactions. This trading environment proved more difficult than previous quarters because most companies reported positive results, but those results were weaker than they were three months ago, which disappointed some investors.

Despite weaker quarterly guidance compared to last quarter, guidance announcements through November show more positive than negative releases. This pattern typically only occurs during early stages of a cyclical bull market, having happened only twice in the past 25 years: following the Financial Crisis and after the COVID lockdowns.

Economic Data Blackout

The ongoing government shutdown has now exceeded 40 days, surpassing the previous record of 35 days set in 2018. This historic shutdown has created a complete blackout of key economic indicators. The US Labor Department did not release the October jobs report on Friday, marking the second consecutive month without official labor market data.

The implications have spread to Main Street as Transportation Secretary Sean Duffy announced plans to cut flights by 10% at 40 major airports, potentially affecting 3,500 to 4,000 flights daily. By Friday morning, more than 700 US flights had already been canceled with no immediate end to the shutdown in sight.

Alternative economic data painted a concerning picture. The University of Michigan Consumer Confidence survey showed sentiment collapsed to its second-lowest level on record, recording a November reading of 50.3, well below expectations of 53.0. This marked a reading even lower than levels seen during the 2008 financial crisis.

Challenger Gray data revealed a sharp rise in job cuts during October, with layoffs reaching 153,074 for the period—triple September's level and climbing 183% month-over-month. This represents the highest number of layoffs for any October since 2003, while 2025 marks the worst year for announced layoffs since 2009. The labor market continues to rapidly decline, reinforcing the case for further Federal Reserve rate cuts.

Market Breadth and Technical Indicators

Market breadth continued to weaken throughout the week. Our advance/decline oscillator turned negative for the first time since April, a development that historically precedes continued selling pressure. When the oscillator crosses into negative territory, markets typically continue downward for an extended period.

Despite the market coming off an all-time high with investors remaining modestly bullish on the overall market, sentiment toward individual stocks has become the most pessimistic since April. This divergence between broad market sentiment and individual stock sentiment often creates interesting trading opportunities.

On Friday, after initially moving lower, the market bounced into the close and in after-hours trading moved back above the critical 6,735 level for the S&P 500. More importantly, investors ended the day modestly more bullish about individual stocks they own than they were the day before, marking the first positive sentiment shift since the early days of earnings season. Historically, when our bottom-up sentiment indicator troughs and ticks higher, it has marked at least near-term buying opportunities.

Upcoming Week:

Market Outlook and Technical Setup

The technical picture suggests the recent selloff may have created a favorable entry point. The S&P 500 bounced off 6,630 support and remains above its 6,550 higher low from October 10th. The fundamental backdrop has not shifted in a materially bearish direction—government shutdown concerns and the AI trade pullback appear to have provoked fear, but we believe this dip will be bought.

Multiple technical indicators support a constructive outlook. The daily RSI bounced off approximately 40 support while the daily bottom Bollinger Band shifted higher to 6,588. We expect the most recent higher low is currently being formed, which should set the stage for another push back into record high territory with the S&P 500 reaching 7,000 for the first time in history.

The Russell 2000 provides an important confirmation signal. The index touched its 2022 highs following last year's election but rolled over. Ahead of this earnings season, the index revisited those highs and has been holding above the $240 level. On Friday, the Russell 2000 ETF fell below $240 but worked its way back by Monday's open. As long as the Russell 2000 remains above this key level, the bias should be to the upside.

Historical patterns strongly favor a year-end rally. When examining the 25-year period through Cisco's earnings release (which typically marks the end of earnings season), data shows the S&P 500 has increased an average of 1.1% from that point until year-end. More significantly, during years when positive guidance announcements outnumber negative ones—as is currently the case—the average year-end rally jumps to 4.1%.

Key Earnings Releases

Cisco Systems reports Wednesday and could face guidance challenges related to the government shutdown. The company derives just under 10% of revenue from the US federal government, creating potential downside risk. However, enterprise IT budgets continue growing heading into 2026, and the company's commentary should be upbeat. Weakness from any guidance disappointment should ultimately be bought.

Disney reports Thursday in what could be a pivotal moment for the stock. Earnings estimates have been trending higher since early 2023, yet the stock has made multiple failed attempts to break above $120 resistance. If earnings continue rising, they will eventually push the stock through this resistance level and signal a breakout from a long base.

While consumer spending shows softness, travel remains firm and Disney's parks appear resilient. The company has new cruise ships and theme-park expansions to drive capacity growth. The streaming business presents the most questions but also the most upside potential, with the combination of Hulu and Disney+ along with price increases expected to drive both revenue growth and margin expansion.

Sentiment toward Disney has dropped to levels reached only three times over the past five years. Historically, purchasing the stock when sentiment reaches current levels has resulted in average three-month gains of 9.4% with a 74.4% success rate, compared to just 2.7% average gains and 59.8% success rate at other times.

Oil:

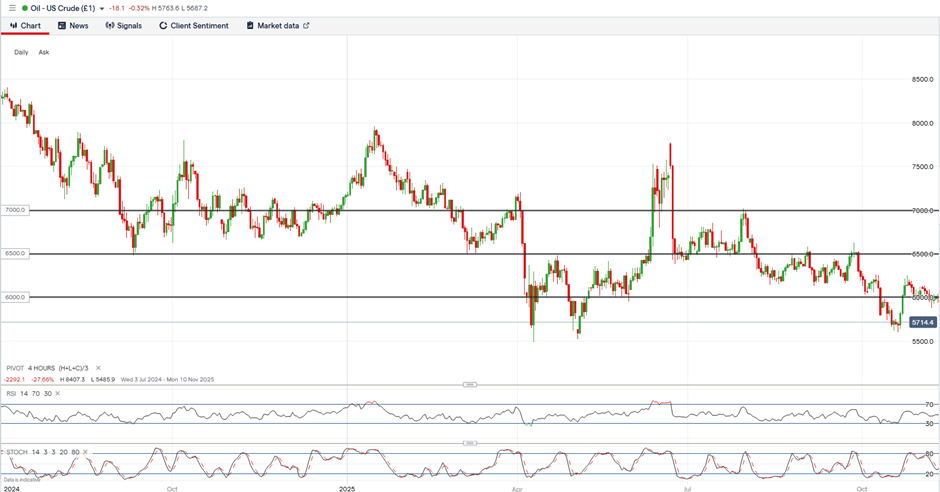

Price Action and Market Dynamics

WTI crude for December delivery closed the week 1.55% lower at $59.87, posting a two-week losing streak driven by oversupply concerns and a questionable demand outlook. The market attempted to rally above $60.00 late in the week but encountered resistance at $61.50 during intraday trading on November 3rd.

Crude prices dropped back below the pivotal $60.00 level during intraday trade on November 7th, highlighting the persistent downward pressure on energy markets. This weakness persists despite typically supportive factors like Federal Reserve rate cuts, underscoring the strength of bearish forces currently impacting crude markets.

Supply Side Pressures

Supply-side dynamics continue weighing heavily on prices. OPEC+ announced plans to further increase production by another 137,000 barrels per day in December, building on multiple output hikes already implemented in 2025. Shortly thereafter, Saudi Arabia sharply reduced the official selling price for December loadings of its flagship Arab Light crude to Asian customers by $1.20 per barrel—a clear sign of caution from the world's largest oil exporter.

President Trump has repeatedly stated his goal to achieve $2.00 per gallon gasoline prices, creating an implicit ceiling on crude oil prices. This political priority suggests the administration appears willing to encourage production increases and may resist any meaningful rally in energy markets, representing a structural headwind that could cap upside attempts for an extended period.

Demand Concerns

Demand-side concerns intensified following the University of Michigan Consumer Confidence data release. The survey showed consumer confidence collapsed to its second-lowest level on record, even below 2008 lows. This resurfaced serious concerns about weaker crude oil demand heading into 2026.

On top of weakening consumer sentiment, the ongoing supply glut continues to pressure markets. Given the mildly bearish fundamental backdrop and the severely oversupplied market conditions, we see minimal technical support to the downside prior to $56.00.

Technical Outlook

From a technical perspective, WTI crude shows a bearish configuration. Early upside last week led directly into $61.50 resistance which was rejected, accompanied by rejection of approximately 52 downtrend resistance in the daily RSI and a subsequent lower high in the indicator.

The daily Bollinger Bands have converged significantly, with the top band at $62.50 and bottom band at $56.75. Meanwhile, the daily top Bollinger Band continued shifting lower while the daily bottom Bollinger Band inched higher, indicating consolidation that typically precedes a directional move.

We expect the next move will fill the mid-October gap spanning from $56.00 to $60.00, ultimately resulting in a quick decline toward the $58.00 target. Price action continues forming both lower highs and lower lows—a textbook sign of a downtrend. Therefore, we remain bearish on WTI crude with a $58.00 target and $66.00 stop-loss.

Metals:

Gold Market Overview

Gold prices for December delivery closed the week 0.10% lower at $4,010 per ounce. Despite the modest decline, gold remains firmly above the critical $4,000 psychological level and continues benefiting from an exceptionally strong fundamental backdrop.

The US Dollar Index attempted to break above the key 100.000 level last week but was rejected, leading to a drop back below 99.50 on November 7th. This came with a move above 70 in the daily RSI for the first time this year and a cross above the 100.24 daily top Bollinger Band, both pointing to a prolonged move lower in the Dollar Index.

The recent strength in the US Dollar appears unsustainable from a technical perspective. Without sufficient fundamental support for a sustained Dollar rally, we expect this strength to prove temporary, removing a key headwind for gold prices.

Fundamental Support Factors

The fundamental picture for gold has only improved. Physical gold demand and ETF gold demand remained very strong with inflows continuing over recent weeks. Multiple supportive factors underpin the bullish case for precious metals.

Central bank demand continues at historically elevated levels while geopolitical tensions persist globally. Real interest rates remain in negative territory despite recent nominal rate increases. The ongoing government shutdown creates uncertainty about economic data and fiscal policy—traditionally supportive factors for gold as a safe-haven asset. Additionally, inflation remains elevated while the labor market weakens.

The record run in gold prices appears set to resume in coming weeks and months as these fundamental tailwinds persist and strengthen.

Technical Analysis and Outlook

Gold held its October 28th low of $3,901 for the second consecutive week and continued drifting higher, pushing back above $4,000. The daily RSI bounced off approximately 45 support while both the daily top and bottom Bollinger Bands pushed higher, now at $4,313 and $3,870 respectively.

The technical correction has actually improved the sustainability of the uptrend. Gold's pullback allowed crucial technical indicators to reset to healthier levels. The daily RSI has declined from overbought territory to approximately 51, creating substantial room for renewed upside.

The daily bottom Bollinger Band has shifted to $3,870, its highest level on record, suggesting long-term support levels continue rising. Meanwhile, the daily top Bollinger Band remains elevated at $4,313, indicating significant upside potential from current levels.

We believe a near-term uptrend is forming and the October 27th gap is set to be filled up to $4,125. If the $3,901 low from October 28th holds again this week, the most recent higher low will officially be solidified before opening the path for a run back toward $4,400. Therefore, we remain bullish on gold with a $4,400 target and $3,950 stop-loss.

Stock Picks

Disney (DIS) - Long Base Breakout Potential

Company Overview

Disney represents a compelling opportunity as the stock approaches a potential breakout from a long base. The company reports fourth quarter 2025 earnings on Thursday, November 13th at 6:40 AM ET. Market expectations call for EPS of $1.12 on revenue of $22.88 billion.

Earnings estimates bottomed at the beginning of 2023 and have been trending higher ever since. Throughout this period, the stock has made multiple attempts to move above $120 resistance, only to be rejected each time. Eventually, if earnings continue being revised higher, they will push the stock through this resistance level and signal a breakout from the long base.

Growth Catalysts

While the consumer shows softness overall, travel is holding firm and the company's parks appear resilient. Disney has new cruise ships and theme-park expansions to help drive capacity in coming years, providing structural growth opportunities beyond the current cycle.

At the box office, the company had decent success during the quarter with The Fantastic Four and continued benefiting from Lilo & Stitch. However, the coming quarter should see the most strength, with TRON: Ares, Zootopia 2, and Avatar: Fire and Ash slated for release.

The streaming business presents the most questions but also potentially the most upside. Disney is combining Hulu with Disney+ and raising prices, which should help on both the top and bottom line. The expansion of ESPN's direct-to-consumer offering is driving additional growth. While there are potential concerns about higher churn following price increases and slowing net additions, Disney's streaming business should ultimately provide revenue growth and margin expansion.

Sentiment Analysis

Sentiment has dropped going into the company's earnings release and has fallen to a level reached only three previous times over the past five years. While earlier this year ahead of Liberation Day the stock briefly continued lower, it was still substantially higher a few months later.

In 2023, current sentiment levels marked the bottom for the stock. Over the past 25 years, purchasing the stock when sentiment was at current levels would have resulted in an average three-month gain of 9.4% with profitable outcomes 74.4% of the time. This compares dramatically to any other time over the past 25 years, which would have averaged just a 2.7% three-month gain with 59.8% profitability.

The bearish sentiment suggests there will be more buyers than sellers on any positive news. None of the current developments are expected to drive significant upside to estimates in the immediate term, but the trend in earnings estimates is expected to continue higher, which should eventually put pressure on the $120+ resistance area.

If a break of that resistance is going to happen, it is probably most likely when investors least expect it—which makes now a compelling time. With sentiment at extreme lows and the long-term earnings trend intact, Disney offers an asymmetric risk-reward opportunity for patient investors willing to look through near-term volatility.

Closing:

Current Portfolio Positioning

We maintain a net long position in the overall stock market, reflecting our constructive outlook for equities in the current environment. We believe the combination of strong corporate earnings, continued Federal Reserve accommodation despite recent hawkish rhetoric, and robust technology sector capital expenditure plans supports further upside in major indices.

Within our equity portfolio, we hold long positions in two names that represent core themes we expect to drive market performance in coming months. Specifically, we maintain positions in Nvidia and Coherent. These holdings reflect our conviction in the sustainability of AI infrastructure spending and identify companies best positioned to benefit from this multi-year capital expenditure cycle.

Strategic Rationale

The thesis for our AI infrastructure holdings has been significantly reinforced by recent earnings commentary from major cloud providers. Amazon's announcement of $34.2 billion in third quarter CapEx with plans to increase to $35.1 billion in Q4, Microsoft's spending of $34.9 billion, Meta's raised full-year 2025 guidance to $70-72 billion, and Alphabet's increased estimate to $91-93 billion all point to sustained demand for AI servers, networking equipment, and specialized chips.

This massive and growing capital deployment creates a highly favorable backdrop for our holdings. Nvidia continues dominating GPU supply for AI training and inference workloads. Coherent supplies essential components for the AI infrastructure buildout. The combination of these positions provides exposure to the AI infrastructure theme across multiple layers of the technology stack.

We have not made any changes to these positions during the past week. The recent technical consolidation in large-cap technology stocks, including volatility in our AI infrastructure holdings, appears healthy after the strong run from April lows. We view any near-term weakness as an opportunity to potentially add to positions rather than a signal to reduce exposure, provided the fundamental thesis remains intact based on continued CapEx commitments from hyperscale cloud providers.

Trading Strategy and Risk Management

For the S&P 500, we maintain our bullish stance with a target of 7,000 and a stop-loss at 6,550. The recent pullback to 6,630 following heightened concerns created a favorable entry point, with key technical support levels holding and momentum indicators resetting to healthier levels. We continue viewing pullbacks related to temporary factors as potential buying opportunities rather than fundamental threats to the equity bull market.

In commodities, we remain bearish on WTI crude oil with a $58.00 target and $66.00 stop-loss. The fundamental backdrop for energy remains challenged by rising supply, political pressure for lower prices, and mixed demand signals. Price action continues forming lower highs and lower lows, providing a textbook downtrend pattern.

Conversely, we maintain our bullish stance on gold with a $4,400 target and $3,950 stop-loss. The recent technical correction improved the sustainability of the precious metals uptrend by allowing overbought indicators to reset. We view the pullback as healthy consolidation that sets up renewed gains.

Overall, our positioning reflects confidence in the continuation of the equity bull market, supported by strong corporate fundamentals, accommodative monetary policy trajectory, and constructive technical setup following recent consolidation. We remain focused on the AI infrastructure theme within equities while maintaining tactical positions in other asset classes to capture what we view as favorable risk-reward opportunities. The combination of improving sentiment indicators, positive guidance trends, and strong historical patterns for year-end performance reinforces our constructive market outlook.

What's Next?

We want to hear from you. Hit reply and tell us: What's your biggest investment challenge right now?

Whether it's timing entries, managing risk, or identifying the next major opportunity—we read every response and use your feedback to make our research even more valuable.

Here's to your financial success,

Sincerely,

7AM Team

IMPORTANT DISCLAIMER

This report represents analysis and opinion rather than investment advice or recommendations. All views expressed reflect our current thinking and may change as new information becomes available. Past performance does not guarantee future results.

Readers should conduct their own research and consult with qualified financial advisors before making investment decisions. Market conditions can change rapidly, and positions discussed may not be suitable for all investors depending on individual circumstances, risk tolerance, and investment objectives.

The information provided is believed to be accurate but is not guaranteed. We do not warrant the completeness or timeliness of information presented. Investing involves risk including possible loss of principal. There is no assurance that any investment strategy will achieve its objectives.