Executive Summery:

• S&P 500 advances 1.15% to record close at 6,966 amid geopolitical developments including US capture of Venezuela's President Maduro

• December payrolls show 50,000 jobs added versus 60,000 expected, while unemployment rate falls to 4.4%

• Markets price in Fed pause at January 28th meeting with no further cuts expected until June 2026

• Early January guidance trends turn positive with 71 companies providing upside guidance versus 24 negative, supporting higher equity prices through earnings season

• Gold surges 4.15% to $4,519/oz on safe-haven demand while ignoring US Dollar strength

• Natural gas extends decline 13.74% to $3.15 on winter demand weakness, approaching oversold technical levels

• President Trump announces $200 billion mortgage bond purchase program and ban on institutional single-family home purchases

Previous Week:

Equity Market Performance

The S&P 500 closed the week 1.15% higher at 6,966, marking a record close as markets navigated a series of significant geopolitical and economic developments. The week opened with news that the US had captured Venezuela's President Maduro on January 2nd, but equity markets quickly shrugged off initial concerns and priced out the geopolitical risk premium that had been building. The capture led to US demands for full control over Venezuela's oil sector, with Washington announcing it will control the country's oil sales and revenue indefinitely.

Despite escalating tensions in other regions, including renewed protests in Iran and continued Russia-Ukraine conflict, equity markets remained largely unfazed throughout the week. We believe this resilience reflects the market's underlying strength and the continued dominance of structural themes, particularly the ongoing AI Revolution that continues to drive record capital expenditure across major technology companies.

From a technical perspective, the S&P 500 held its January 2nd higher low at 6,824, which came with support at approximately 52 in the daily RSI. This set the foundation for the push to record highs later in the week. The daily top Bollinger Band continued its upward trajectory, closing the week at 6,997. The daily RSI pushed above 60 resistance, sitting approximately 10 points below overbought levels, suggesting room for additional upside momentum.

Employment and Economic Data

The December employment report showed nonfarm payrolls increasing by 50,000, falling short of the 60,000 consensus estimate. The unemployment rate declined to 4.4%, an improvement from the revised 4.5% prior reading and below expectations of 4.5%. However, the report contained significant downward revisions to prior months that warrant attention.

October's payroll data was revised sharply lower by 68,000 jobs, from negative 105,000 to negative 173,000. November's figure was revised down by 8,000 jobs, from 64,000 to 54,000. This pattern of downward revisions has characterized every month of 2025 except December, for which no revisions have yet been issued. The persistent negative adjustments suggest labor market conditions may be softer than headline figures initially indicate.

Corporate Earnings Outlook

Early guidance trends for 2026 have turned decisively positive, providing fundamental support for equity markets entering earnings season. Through the first 12 days of January, 140 companies issued guidance, with 71 providing positive outlooks, 24 offering negative guidance, and 45 remaining inline. This results in a net positive guidance rate of 34%, well above typical patterns.

Historical analysis demonstrates the importance of this early guidance pattern. When positive guidance exceeds negative guidance in the first 12 days of January, the S&P 500 has advanced 67% of the time over the subsequent four-week earnings period, with an average gain of 0.8%. Conversely, when negative guidance dominates, the index rises only 50% of the time with an average return of negative 0.3%.

Earnings statistics through January 12th show 70% of companies beating consensus EPS estimates, compared to a historical average of 68%. Revenue surprises remain solid at 71.4%, though slightly below the typical 72.9% rate. The combination of positive guidance trends and solid earnings execution creates a supportive backdrop for stocks during the peak reporting period in mid to late February.

Upcoming Week:

Market Outlook and Technical Setup

The technical setup for the S&P 500 appears constructive as markets position for a potential break above 7,000 for the first time in history. The January 2nd low at 6,824 formed a textbook higher low pattern following the December rally, accompanied by support at approximately 52 in the daily RSI. The subsequent push to a record close at 6,966 on January 9th established a higher high, confirming the continuation of the broader uptrend.

We believe the engine driving this market remains fundamentally strong despite ongoing geopolitical developments. The AI infrastructure buildout continues to accelerate, with major technology companies maintaining unprecedented capital expenditure commitments. Additionally, tariff-related headwinds have diminished considerably compared to just two months ago, as President Trump shifts focus toward the midterm elections which he views as crucial for his administration's policy agenda.

Even intraday declines have failed to hold, suggesting persistent buying interest and strong upward momentum. The daily RSI remains approximately 10 points below overbought levels, providing technical room for additional gains. The daily top Bollinger Band sits at 6,997, just above current levels, with the potential to continue shifting higher as price exploration extends into record territory.

We expect dips to continue being bought as has been the pattern throughout the current bull market. The combination of positive earnings guidance trends, solid economic fundamentals driven by AI investment, and favorable technical positioning supports our expectation for new record highs. Therefore, we remain bullish on the S&P 500 with a 7,000 target and 6,700 stop loss.

Federal Reserve Policy and Monetary Conditions

Fed Chair Powell's commentary following recent meetings has introduced notable uncertainty regarding the path of monetary policy. Markets now price in a 95% probability of no change to interest rates at the January 28th meeting, representing a shift from earlier expectations. The base case assumes the Fed will remain on hold until June 2026, marking the first meeting under President Trump's new Fed Chair whose nomination is expected this month.

Despite the hawkish shift in rate expectations, we believe the Fed will ultimately maintain an accommodative stance through other policy tools. The decision to end quantitative tightening beginning December 1st signals a broader commitment to maintaining supportive financial conditions. The ongoing data uncertainty, particularly given recent employment report revisions, provides the Fed flexibility to support the labor market through alternative means.

Key Economic Data Releases

Several important macroeconomic releases this week will provide additional insight into economic conditions and may influence market direction. December CPI data releases on Monday, followed by November retail sales and December existing home sales on Tuesday. The Fed's Beige Book, also due Tuesday, will offer qualitative assessment of economic conditions across Federal Reserve districts.

Manufacturing sector indicators arrive mid-week, with January readings for both the Philadelphia Fed and Empire Manufacturing surveys on Wednesday. December industrial production and capacity utilization data follow on Thursday. Consensus expectations call for industrial production to continue rising, potentially exceeding the July high. The direction of industrial production typically correlates with stock market performance, and a stronger reading would provide further support for equity valuations.

Inflation expectations remain largely muted in consensus forecasts, while retail sales are anticipated to show strength. The combination of solid consumer spending, moderate inflation, and improving industrial production would reinforce the view that economic fundamentals remain supportive of higher asset prices despite ongoing policy uncertainties.

Notable Earnings Releases

TSMC reports earnings Thursday morning before market open, representing a critical bellwether for AI infrastructure demand. The company pre-announced revenue of $33.10 billion, above the consensus estimate of $32.60 billion and within the upper end of company guidance. However, the consensus EPS estimate of $2.76 implies a sequential margin decline that appears inconsistent with management's guidance for gross margins between 59% and 61%, suggesting potential upside to earnings expectations.

We believe positive guidance from TSMC appears likely given five consecutive quarters of upbeat forward outlooks. The stock has consolidated between $258 and $310 over recent months and broke above $310 in early January. A measured move from the $258 base projects a technical target of $362. When TSMC beats estimates and provides positive guidance, the stock has gapped higher 77% of the time with an average gain of 2.4%, though it typically fades over the following days with an average decline of 2.0% two days later.

Credit Market Considerations

President Trump's announcement of a 10% cap on credit card interest rates for one year, effective January 20th, introduces uncertainty for consumer finance companies. Current average APRs stand at 25.2% for general credit cards and 31.3% for private label cards. While the 10% figure likely represents an opening negotiating position with the actual cap expected closer to 20%, the policy still presents material risks to earnings for exposed companies.

Synchrony Financial faces the most significant exposure, with consensus expectations of $2.15 EPS for the March quarter potentially at risk. The stock gapped to its previous upward trendline at $80 following the announcement, and we expect downward estimate revisions to pressure the shares lower in coming months. American Express appears better positioned but still faces margin decline risks, while Capital One sits somewhere between the two with moderate exposure. The policy announcement has already triggered downward technical breaks in all three names.

Oil:

Price Action and Market Dynamics

WTI crude for February delivery closed the week 2.51% higher at $58.75, with volatility driven by shifting geopolitical developments and supply considerations. The market initially reacted bearishly to news of Venezuela's President Maduro being captured, as participants recognized this would ultimately bring more supply to market. Prices dropped as low as $55.76 on January 7th before reversing sharply higher as tensions escalated in Iran, reaching $59.77 on Friday.

The capture of Maduro has significant implications for global oil supply. Following the development, President Trump demanded that Venezuela grant the US full access to its oil sector. US officials confirmed Washington will control the country's oil sales and revenue indefinitely. Major firms including Chevron are now competing for government deals to market up to 50 million barrels that state-run PDVSA has accumulated in inventories during years of severe embargo and multiple tanker seizures.

Beyond Venezuela, supply disruption concerns increased due to civil unrest in major Middle Eastern producer Iran and ongoing concerns about potential impacts to Russian oil exports from the spreading conflict in Ukraine. However, the demand outlook remains uncertain, and the market continues to factor in President Trump's explicit desire for lower energy prices with retail gasoline falling below $2.00 per gallon.

Technical Analysis and Trading Range

From a technical perspective, WTI crude rejected approximately 55 resistance in the daily RSI on Friday and crossed above its $59.27 daily top Bollinger Band, but remains confined within its recent trading range. The commodity continues to trade between $55.00 and $62.00 support and resistance levels, effectively serving as dead money for traders seeking directional exposure.

We do not see a favorable setup to either direction at current levels. The initial bearish reaction to the Venezuela news, which would logically increase supply, was quickly reversed by geopolitical concerns in Iran. However, the fundamental backdrop of increasing supply availability, political pressure for lower prices, and mixed demand signals suggests limited upside potential. We await a more favorable technical setup showing clear directional momentum and maintain a neutral outlook on crude oil.

Metals:

Gold Market Overview

Gold for February delivery closed the week 4.15% higher at $4,519 per ounce, demonstrating remarkable strength as investors weighed employment data and geopolitical uncertainties. The advance proved particularly notable given the simultaneous rally in the US Dollar Index to 99.26 on January 9th. We believe this divergence highlights the exceptional fundamental support underlying precious metals markets at present.

The week's mixed employment report, showing fewer jobs added than expected but a declining unemployment rate, contributed to safe-haven demand for gold. However, the geopolitical landscape provided the primary catalyst for the advance. Intensifying unrest in Iran, continued fighting in Russia's war with Ukraine, the US capture of Venezuela's President Maduro, and Washington's renewed signals regarding Greenland all contributed to elevated risk premiums.

Interestingly, gold's strength persisted despite the sharp rally in the US Dollar Index. This unusual pattern suggests that typical inverse correlations between the dollar and gold have broken down, likely reflecting the unique combination of geopolitical tensions and monetary policy uncertainties. We expect the Dollar Index to form another lower high with rejection of 99.00 to 100.00 resistance, which would remove a traditional headwind and further propel gold toward new record highs.

Fundamental Support Factors

The fundamental case for gold ownership remains robust across multiple dimensions. Central bank demand continues at historically elevated levels, driven by diversification away from dollar reserves and hedging against policy uncertainty. Geopolitical tensions persist across multiple regions, creating sustained safe-haven demand. Real interest rates remain in negative territory despite nominal rate increases, reducing the opportunity cost of holding non-yielding assets.

In our assessment, there has never been a stronger environment in modern history for gold markets. The combination of elevated geopolitical risks, monetary policy uncertainty, negative real rates, and sustained central bank buying creates multiple reinforcing tailwinds that continue improving month over month. This structural support suggests the current bull market in precious metals has considerable room to extend.

Technical Analysis and Price Outlook

Gold confirmed its higher low from December 31st at $4,284 with last week's sharp rally. This level marked a bounce from the bottom of the upward trending channel, came with a shift higher in the daily bottom Bollinger Band to $4,261, and coincided with support at approximately 50 in the daily RSI. The technical correction improved the sustainability of the uptrend by allowing momentum indicators to reset to healthier levels.

The daily RSI currently sits at approximately 63, well below overbought territory and creating substantial room for renewed upside. Meanwhile, the daily bottom Bollinger Band has shifted to $3,877, its highest level on record, demonstrating that long-term support levels continue to rise structurally. The daily top Bollinger Band remains elevated at $4,564, indicating significant upside potential from current levels toward new record highs.

We expect a sustained move above the $4,500 level to open the path toward new all-time highs above the December 26th record of $4,584. The combination of improved technical positioning following the correction, strong fundamental support across multiple dimensions, and the likely temporary nature of Dollar strength creates a compelling setup for renewed gains. Therefore, we remain bullish on gold with a $4,600 target and $4,150 stop loss.

Stock Picks

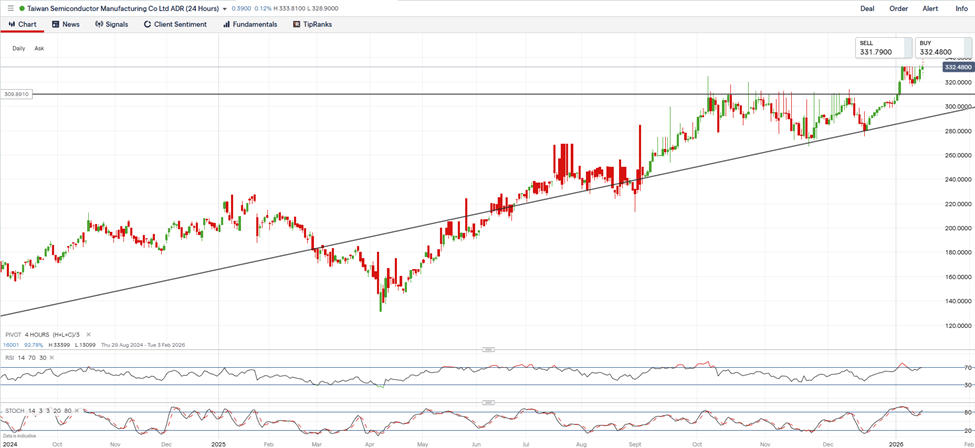

TSMC - Strong Buy Above $310 Support

Company Overview and Recent Performance

TSMC represents the most critical bellwether for AI infrastructure demand given the company's dominant position in advanced semiconductor manufacturing. The company reports fourth quarter 2025 earnings on Thursday, January 15th before market open. TSMC pre-announced revenue of $33.10 billion on Friday, exceeding the consensus estimate of $32.60 billion and landing near the upper end of management's guidance range of $32.20 billion to $33.40 billion.

Current consensus expectations call for EPS of $2.76, but we believe this estimate understates likely results. The consensus figure implies a sequential decline in gross margins, which appears inconsistent with management's prior guidance. During last quarter's conference call, CFO Wendell Huang indicated gross margins would range between 59% and 61%, representing a 50 basis point sequential increase at the midpoint. This guidance suggests meaningful upside potential to the current consensus earnings estimate.

Growth Catalysts and Market Position

TSMC benefits from its position at the center of the global AI infrastructure buildout. The company manufactures the most advanced chips for Nvidia, AMD, and other leading semiconductor designers powering AI applications. Major cloud providers continue to announce record capital expenditure plans, with combined spending exceeding $250 billion for 2026. This unprecedented investment cycle directly benefits TSMC through sustained demand for its most advanced manufacturing processes.

The company has delivered positive guidance for five consecutive quarters, establishing a consistent pattern of exceeding expectations and raising outlooks. This track record, combined with the structural tailwinds from AI investment, positions TSMC as one of the highest-conviction names in the technology sector. We expect management to maintain this pattern with another beat-and-raise quarter on Thursday.

Technical Setup and Trading Strategy

TSMC stock has consolidated between $258 and $310 for most of the past quarter, despite strong October 30th earnings results. The consolidation ended with a gap above $310 on the first trading day of 2026, and the stock has held this breakout level since. From a technical perspective, the consolidation base at $258 projects a measured move target to $362, representing approximately 17% upside from current levels near $310.

Historical patterns show TSMC stock reacts positively to earnings beats. When the company exceeds consensus EPS estimates, shares have gapped higher 71% of the time with an average gain of 2.4%. More significantly, when TSMC both beats estimates and provides positive forward guidance, the stock has gapped higher 100% of the time with an average immediate move of 18.2%. However, these gains typically fade over subsequent sessions, with the stock declining an average 2.0% two days after positive guidance announcements.

This historical pattern suggests a specific trading approach. The initial gap higher on Thursday morning provides an attractive entry point for short-term traders, but holders should consider taking profits within the first day or two. For longer-term investors, any post-earnings weakness following an initial spike would likely represent a buying opportunity given the strength of the underlying fundamental thesis.

We view TSMC as a core holding for portfolios seeking exposure to AI infrastructure spending. The stock trades above $310 support with favorable technical momentum as the daily RSI remains below 69 and the top Bollinger Band has shifted to $275.13. We believe a move toward $290 to $300 appears likely over the near term, with the $362 measured move target achievable over the coming months as the AI buildout continues.

Following positive TSMC guidance, certain semiconductor equipment and component suppliers have historically shown strong relative performance in the window between TSMC's report and their own earnings. We believe three names merit attention for this pattern: Monolithic Power Systems, Impinj, and SiTime. None have confirmed February earnings dates yet, but all typically report in early February.

Over the past several years, buying these stocks at the open after TSMC provides positive guidance and holding through the open after their own earnings has resulted in favorable outcomes more than 75% of the time. Monolithic Power Systems has averaged gains of 4.36%, Impinj has averaged 8.73%, and SiTime has averaged 8.96%. Notably, SiTime currently holds above its 2021-2022 highs, suggesting improving fundamental momentum for the business.

Closing:

Current Portfolio Positioning

We maintain a net long position in the overall stock market, reflecting our constructive outlook for equities in the current environment. We believe the combination of solid corporate earnings momentum, positive guidance trends entering earnings season, and robust AI infrastructure capital expenditure plans supports further upside in major indices despite elevated valuations by traditional metrics.

Within our equity portfolio, we currently hold long positions in TSMC that represent our highest-conviction views on market themes we expect to drive performance in coming months.

Positioning Across Asset Classes

For the S&P 500, we maintain our bullish stance with a target of 7,000 and stop loss at 6,700. The pullback to 6,824 following the employment report created what we view as a favorable entry point, with key technical support levels holding and momentum indicators resetting to healthier levels. We continue to view geopolitical headlines and policy uncertainties as noise and temporary buying opportunities rather than fundamental threats to the equity bull market.

In commodities, we hold a neutral view on WTI crude oil as prices remain range-bound between $55 and $62. The fundamental backdrop remains challenged by rising supply availability, political pressure for lower energy prices, and mixed demand signals. We await a more favorable directional setup.

We have shifted to a bullish stance on natural gas with a $3.70 target and $3.10 stop loss. The recent decline to $3.15 has created oversold technical conditions with the daily RSI at 31 and prices trading below the bottom Bollinger Band. We believe a relief rally toward $3.70 resistance represents an attractive risk-reward opportunity.

We remain bullish on gold with a $4,600 target and $4,150 stop loss, viewing the technical correction from late December as a healthy reset that improves the sustainability of the precious metals uptrend. The fundamental case for gold ownership has never been stronger, with central bank buying, geopolitical tensions, and negative real rates all providing support.

What's Next?

We want to hear from you. Hit reply and tell us: What's your biggest investment challenge right now?

Whether it's timing entries, managing risk, or identifying the next major opportunity—we read every response and use your feedback to make our research even more valuable.

Here's to your financial success,

Sincerely,

7AM Team

IMPORTANT DISCLAIMER

This report represents analysis and opinion rather than investment advice or recommendations. All views expressed reflect our current thinking and may change as new information becomes available. Past performance does not guarantee future results.

Readers should conduct their own research and consult with qualified financial advisors before making investment decisions. Market conditions can change rapidly, and positions discussed may not be suitable for all investors depending on individual circumstances, risk tolerance, and investment objectives.

The information provided is believed to be accurate but is not guaranteed. We do not warrant the completeness or timeliness of information presented. Investing involves risk including possible loss of principal. There is no assurance that any investment strategy will achieve its objectives.