Executive Summery:

• S&P 500 closes week marginally higher at 6,734 following volatile trading as the 43-day government shutdown ends

• Third quarter earnings season shows strong results with 82% of companies exceeding EPS expectations and 76% beating revenue forecasts

• Federal Reserve policy uncertainty increases as markets price in only 56% probability of December rate cut amid inflation concerns

• Market experiences fifth Hindenburg Omen signal indicating underlying weakness despite overall index strength

• Consumer spending patterns show significant bifurcation with middle-income segment shrinking while affluent consumers remain strong

Previous Week:

Equity Market Performance

The S&P 500 delivered modest gains of 0.12% last week, closing at 6,734, navigating through heightened volatility driven by the government shutdown resolution, ongoing earnings releases, and shifting investor sentiment into year-end. Markets demonstrated resilience despite mixed signals, though the technical picture revealed concerning divergences beneath the surface.

The index began the week with strength, surging to 6,870 on November 12th before reversing sharply. This decline accelerated into an intraday low of 6,646 on November 14th, representing significant intraweek volatility. However, the market found critical support at the 6,650 level, staging a dramatic reversal that added over $1 trillion in market capitalization within three hours of trading. This V-shaped recovery suggests strong dip-buying interest remains intact.

Technical indicators provided mixed signals throughout the week. The S&P 500 briefly crossed below the daily bottom Bollinger Band at 6,676 during the Thursday selloff, while the daily RSI dropped below 50 before recovering. These oversold readings triggered buying interest that powered the subsequent rebound. The daily top Bollinger Band now sits elevated at 6,916, indicating room for upside momentum.

Market breadth raised red flags despite the index's resilience. A fifth Hindenburg Omen triggered during the week, joining four previous signals within the past month. These technical warnings occur when both new highs and new lows expand simultaneously while the index remains in an uptrend. While Hindenburg Omens can produce false signals, clusters of five or more have historically preceded major market selloffs, notably in 2007 before the Financial Crisis and February 2020 before the pandemic collapse.

Corporate Earnings Performance

Third quarter 2025 earnings season continued to exceed expectations across multiple metrics. With 92% of S&P 500 companies having reported, 82% beat EPS expectations while 76% surpassed revenue forecasts. The blended earnings growth rate for Q3 currently stands at 13.1%, substantially above the initial expectation of 7.9%.

The technology sector delivered particularly impressive results, with Magnificent 7 capital expenditure running at approximately $650 billion annually. This sustained AI infrastructure investment continues to drive earnings beats among semiconductor and cloud infrastructure companies. However, market reactions to individual earnings releases have been subdued, with many strong reports met with selling pressure.

Forward guidance showed a healthy tilt toward optimism. For Q3, 230 companies issued positive guidance compared to 163 providing negative outlooks. This 166-company positive differential marks a significant departure from previous quarters and suggests underlying business confidence remains intact despite macroeconomic uncertainties.

Sector performance revealed notable divergence. AI and digital transformation stocks demonstrated exceptional strength, with 83% of AI-focused holdings trading higher since reporting earnings. Conversely, consumer-facing sectors struggled significantly. Only 34% of retail holdings advanced post-earnings, while restaurant stocks performed even worse at just 14% showing gains.

Government Shutdown and Economic Data

The 43-day government shutdown officially ended on Wednesday when Congress and the President approved legislation to reopen federal operations. While markets initially rallied on the news, the celebration proved short-lived as stocks reversed sharply into Thursday's lows.

The prolonged shutdown created a significant data blackout for key economic indicators. The White House indicated some labor market and inflation data from the shutdown period may never be released, including potentially the October unemployment rate. This information vacuum has forced market participants to rely on proprietary data sources and anecdotal evidence.

The absence of official economic data has contributed to increased uncertainty around Federal Reserve policy decisions. Without standard employment and inflation reports, the Fed must navigate its December policy meeting with incomplete information, potentially leading to more cautious policymaking.

Upcoming Week:

Market Outlook and Technical Setup

The technical configuration for equities presents a mixed picture as markets enter the final weeks of 2025. While the S&P 500 formed what appears to be a higher low at 6,646 following last week's dramatic reversal, the index failed to reclaim the critical 6,735 resistance level. This failure to break through suggests the recent weakness may continue in the near term.

Historical patterns following earnings season provide some optimism. When guidance announcements show net positive readings similar to current levels, the S&P 500 has averaged 1.3% gains from the end of earnings season through year-end. For third quarter specifically, this average improves to 4.0% when positive guidance dominates. Current guidance metrics show 166 more positive than negative announcements, placing us firmly in the favorable category.

However, the presence of five Hindenburg Omens during earnings season cannot be ignored. While these signals often produce false alarms, periods with five or more Hindenburg Omens have preceded significant market corrections. The last occurrence was February 2020, immediately before pandemic-related selling. That said, four of the five historical precedents ultimately saw markets rally through year-end despite the warning signals.

We believe near-term trading will pivot on whether the market can reclaim and hold above 6,735 on the S&P 500 or $671 on the SPY. Failure to break through this resistance suggests further downside testing toward 6,550 support. Conversely, a decisive break above 6,735 would negate the bearish technical setup and likely trigger a rally toward 7,000.

Federal Reserve Policy Outlook

Federal Reserve policy has become increasingly uncertain following Chair Powell's November rate decision commentary. His statement that a December rate cut is "far from" a "foregone conclusion" represented a notable hawkish shift. Markets responded by reducing the probability of a December cut from over 90% to just 56%.

The shift in Fed expectations reflects growing concerns about persistent inflation. With inflation rebounding above 3%, some policymakers worry that continued rate cuts could reignite price pressures. However, we believe labor market deterioration will ultimately force the Fed to deliver another 25 basis point reduction in December.

Several factors support our view that the Fed will cut rates despite recent hawkish rhetoric. The ongoing data blackout from the government shutdown will force the Fed to prioritize its employment mandate in the absence of complete information. Additionally, the Fed's decision to end quantitative tightening beginning December 1st signals a broader commitment to maintaining accommodative financial conditions.

The dissent at the November meeting, where one member advocated for a 50 basis point cut rather than 25 basis points, reinforces the dovish tilt within the committee. We expect this dovish faction to prevail at the December meeting, particularly if upcoming economic data shows continued labor market softness.

Key Earnings Releases and Retail Sector Focus

This week brings critical earnings releases from major retailers that will provide insight into consumer health heading into the holiday season. Home Depot, Lowe's, Walmart, Target, TJX Companies, Ross Stores, Bath & Body Works, Gap, Williams-Sonoma, and BJ's Wholesale all report results.

These releases will offer the first comprehensive view of consumer spending since financial companies reported at the start of earnings season. Interestingly, banks and payment processors have consistently described consumer spending as resilient, with both discretionary and non-discretionary categories showing growth. Mastercard and Visa executives noted October spending remained solid across all income segments.

However, recent earnings from consumer-facing companies paint a more nuanced picture. While affluent consumers continue spending freely, middle-income households face increasing pressure. Data from TransUnion shows the middle-income cohort shrinking, with 40% of consumers now classified as super prime while 14% fall into subprime categories. This bifurcation explains divergent performance among retailers.

We expect this week's retail earnings to show continued strength among off-price retailers like TJX and Ross Stores, which benefit from trade-down behavior. Conversely, mid-tier retailers targeting middle-income consumers may disappoint. Walmart and Target will be particularly important as their results span multiple income segments and offer the best read on overall consumer health.

Technology earnings also warrant attention, with Nvidia reporting Wednesday after market close. Expectations are elevated following strong AI infrastructure spending announcements from hyperscale cloud providers. The company should deliver a beat-and-raise quarter, though the stock's recent strength means much good news may already be priced in.

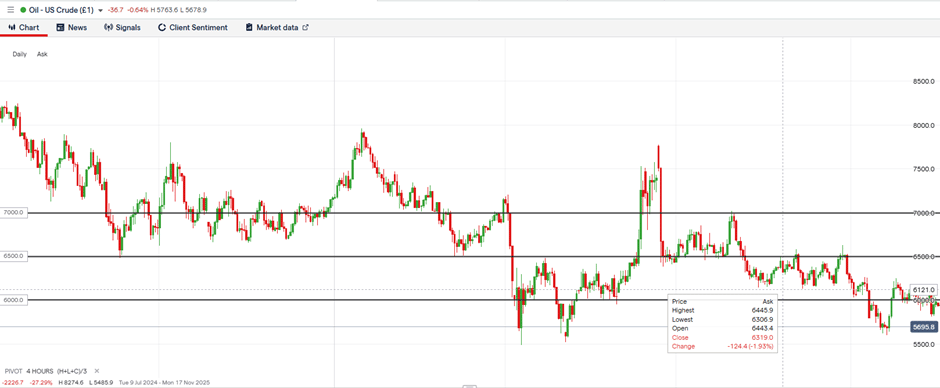

Oil:

Price Action and Supply Dynamics

WTI crude closed the week marginally higher at $59.90 per barrel following a volatile trading pattern that saw prices briefly test our $58.00 downside target before recovering on supply disruption news. The modest weekly gain masks significant intraweek volatility and ongoing fundamental pressures that continue to weigh on energy markets.

Friday's price recovery came after Ukrainian forces attacked the Black Sea port of Novorossiysk, temporarily halting oil exports from this critical Russian energy hub. The strike damaged port facilities and a vessel, prompting a brief supply disruption. While this tactical event provided short-term support, it does little to address the broader bearish fundamentals confronting crude markets.

Supply-side pressures remain the dominant theme. Reuters reported that Saudi Arabia may reduce December crude pricing for Asian buyers to multi-month lows due to ample supplies. This pricing action signals weakening demand from key Asian markets and intensifying competition among global producers.

OPEC+ production increases continue despite prior commitments to restrain output. The eight OPEC+ members implementing production increases have added more than 2.7 million barrels per day, approximately 2.5% of global supply. Meanwhile, Russian oil exports to China and India persist despite U.S. sanctions, with new information suggesting OPEC+ is leaning toward modest output boosts in December.

The Trump Administration's continued advocacy for lower energy prices and $2.00 per gallon gasoline creates an implicit ceiling on crude oil rallies. This political priority suggests the administration will encourage production increases and resist any meaningful rally in energy markets, representing a structural headwind for an extended period.

Technical Analysis and Outlook

From a technical perspective, WTI crude exhibits a clearly bearish configuration. Prices rallied back into the $60.00 to $61.00 resistance zone following Friday's supply disruption news, encountering resistance at $61.30 early in the week before the sharp decline to $58.30. This rejection of higher prices, combined with a concurrent rejection of approximately 53 resistance in the daily RSI, suggests another lower high is forming.

The daily Bollinger Bands have converged significantly, with the top band at $63.35 and bottom band at $56.40, indicating a period of consolidation that typically precedes a directional move. Given the fundamental backdrop of rising supply, political pressure for lower prices, and mixed demand signals, we expect this consolidation to resolve to the downside.

The daily RSI currently trades in a clear downtrend along with price action, now approaching 50 after bouncing from oversold levels. This positioning suggests limited near-term upside potential. We believe another lower high is forming around current levels near $60.00, setting up for a move toward $57.00 in the coming weeks.

Therefore, we maintain a bearish stance on WTI crude with a $57.00 price target and $63.00 stop-loss level. The path appears clear for a sustained break below $60.00 this week, potentially opening the door to a test of $57.00 support. Only a decisive break above $63.00 would negate this bearish outlook and suggest the fundamental headwinds have been overcome.

Metals:

Gold Market Overview

Gold prices for December delivery closed the week 1.80% higher at $4,082 per ounce as the government shutdown resolution brought temporary relief but general market uncertainty persisted. Despite some intraweek volatility, gold maintained firm support above the critical $4,000 psychological level and continues to benefit from an exceptionally strong fundamental backdrop.

The US Dollar Index extended its decline last week, falling into the 99.00 level shortly after rejecting 100.00 resistance on November 5th. This dollar weakness followed an overbought reading above 70 in the daily RSI and a cross above the 100.16 daily top Bollinger Band, both suggesting the dollar rally had overextended. Continued dollar softness provides tailwinds for gold prices looking ahead.

Even with the resolution of government shutdown uncertainty, the fundamental drivers supporting gold ownership remain robust. Federal Reserve policy uncertainty, persistent inflation above target levels, geopolitical tensions, and strong central bank demand all argue for continued gold accumulation. Real interest rates remain in negative territory despite recent nominal rate increases, historically a supportive environment for precious metals.

Technical Analysis and Price Action

Gold demonstrated impressive volatility last week while ultimately maintaining its upward trajectory. Prices surged to an intraweek high of $4,250 on November 13th in an explosive breakout-like rally. This move pushed the daily RSI from approximately 50 into 65, indicating strong momentum behind the advance.

The subsequent pullback on November 14th provided a healthy technical reset. Sharp selling pressure at the open drove prices to an intraday low of $4,033, representing nearly a $200 decline from the highs. However, dip buyers aggressively stepped in at this level, preventing further deterioration and forming what appears to be the most recent higher low in gold's ongoing uptrend.

This correction aligned with a bounce off approximately 50 support in the daily RSI, a level that has historically provided strong buying interest during gold uptrends. Meanwhile, the daily bottom Bollinger Band has shifted up to $3,882, its highest level on record, confirming that long-term support levels continue rising and validating the sustainability of the uptrend.

The daily top Bollinger Band remains elevated at $4,312, indicating significant upside potential from current levels. Combined with the improved technical positioning following last week's correction, the setup appears favorable for renewed gains. We expect a sustained move through last week's $4,250 high this week, ultimately targeting a retest of the $4,398 all-time high from October.

Therefore, we maintain a bullish stance on gold with a $4,400 price target and $3,850 stop-loss level. The combination of improved technical indicators following the correction, strong fundamental support factors, and the likely temporary nature of recent dollar strength creates a compelling setup for renewed gains in precious metals through year-end.

Stock Picks

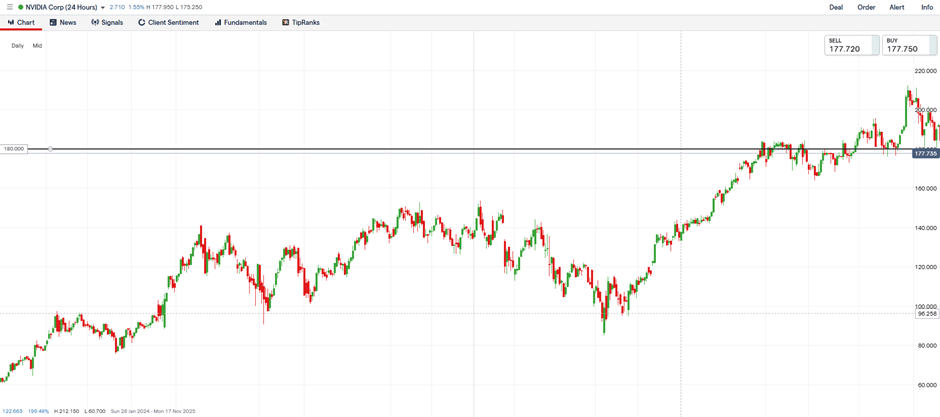

NVIDIA Corporation (NVDA)

Company Overview and Investment Thesis

NVIDIA reports third quarter 2025 earnings on Wednesday, November 19th after market close. Consensus expectations call for EPS of $1.17 on revenue of $54.59 billion. The market anticipates another strong quarter as AI infrastructure spending remains robust across hyperscale cloud providers, enterprise customers, and sovereign AI initiatives.

The fundamental thesis for NVIDIA centers on continued insatiable demand for AI accelerators. Major cloud providers Amazon, Microsoft, Meta, and Alphabet have collectively announced massive capital expenditure increases totaling over $650 billion annually. This unprecedented infrastructure buildout creates sustained demand for NVIDIA's GPU offerings, particularly the latest Blackwell architecture chips.

While custom AI chip development by hyperscalers has raised concerns about future GPU commoditization, NVIDIA maintains significant competitive advantages. The company continues expanding gross margins, with non-GAAP gross margins reaching 72.7% last quarter and guidance suggesting mid-70s margins exiting fiscal year. Management expects to maintain these margin levels through Q3, indicating pricing power remains intact despite competition.

Industry feedback throughout the quarter suggests material acceleration in demand. Reports indicate NVIDIA has fully resolved earlier supply chain issues with rack configurations, allowing shipments to flow more freely. Meanwhile, Neoclouds and sovereign cloud initiatives continue purchasing predominantly NVIDIA GPUs rather than alternatives, validating the company's technological leadership.

Quarterly Performance Expectations

Multiple positive indicators point toward a strong earnings report. Expectations have risen for what some describe as a breakout quarter versus recent trends. The resolution of rack supply chain issues combined with surging demand should translate to revenue exceeding the high end of guidance.

The key metric to watch will be fourth quarter revenue guidance and gross margin projections. Management's ability to maintain or expand the mid-70s gross margin guidance while growing revenue substantially would signal that GPU demand remains far from commoditization. Conversely, any margin pressure would raise concerns about competitive dynamics.

China remains a wildcard. The company took a $4.5 billion charge in Q1 due to China export restrictions. While some China-based customers received licenses for H20 chips, NVIDIA has yet to ship any chips to China and currently has no plans to do so. We view this positively since H20 chips carry lower margins. As long as demand remains strong for higher-margin processors outside China, forgoing Chinese revenue is strategically sound.

Risk Factors and Technical Setup

The primary risks to NVIDIA include rising component costs potentially pressuring margins, increased competition from custom AI chips, and any signs that AI infrastructure spending may be peaking. However, recent hyperscaler earnings calls showed no indication of CapEx moderation, with most companies increasing rather than decreasing their investment plans.

From a technical perspective, the stock has been consolidating following recent all-time highs. The Earnings-AVWAP currently sits around $184.50, providing technical support. The $180 level represents important psychological support as well. The stock has consistently been bought on dips to these levels throughout the quarter.

Sentiment has reached elevated levels with 19.2% of investors positioned bullishly. When NVIDIA has beaten consensus estimates and provided positive guidance in the past, the stock has gapped higher 79% of the time with an average immediate move of 4.3%. These historical patterns suggest significant upside potential if the company delivers a beat-and-raise quarter as expected.

We believe NVIDIA represents an attractive opportunity ahead of Wednesday's earnings release. The combination of strong fundamental momentum, accelerating demand signals, favorable analyst sentiment, and constructive technical setup all point toward upside potential. Current positioning appears favorable for entering ahead of the report or adding on any post-earnings weakness.

Closing:

Current Portfolio Positioning

Our current portfolio maintains a neutral net position in the overall stock market, reflecting caution around near-term technical signals while maintaining conviction in medium-term bullish fundamentals. We believe the market faces a critical inflection point as it attempts to reclaim the 6,735 resistance level on the S&P 500.

Within equities, we hold concentrated long positions in NVIDIA and TJX Companies. NVIDIA provides exposure to the ongoing AI infrastructure buildout theme, which continues showing remarkable strength across enterprise and hyperscale segments. The company's maintained pricing power and expanding margins suggest the GPU market remains far from commoditization despite growing competition from custom chips.

TJX Companies represents our consumer discretionary exposure, offering positioning in the off-price retail segment that benefits from current market bifurcation. As middle-income consumers face increasing pressure and seek value, off-price retailers like TJX gain market share. The company has demonstrated pricing power by offsetting tariff impacts through modest price increases while maintaining strong traffic growth.

Strategic Rationale and Market Outlook

We have not made changes to our equity positions during the past week. The recent volatility and technical consolidation in both holdings appears healthy following strong year-to-date performance. We view near-term weakness as potential opportunities to add to positions rather than signals to reduce exposure, provided fundamental catalysts remain intact.

The broader market faces conflicting signals heading into year-end. Positive factors include strong corporate earnings, more positive than negative guidance, continued AI infrastructure investment, and historical seasonal patterns favoring year-end rallies. Negative factors include Hindenburg Omen warnings, Fed policy uncertainty, weakening consumer segments, and elevated valuations in growth sectors.

We believe the resolution will depend on whether the market can decisively break above 6,735 resistance. A clean break through this level would negate bearish technical patterns and likely trigger a melt-up toward 7,000 by year-end. Failure to reclaim this level suggests further consolidation or potential testing of 6,550 support.

Risk Management and Trading Strategy

For commodities positioning, we remain bearish on WTI crude oil with a $57.00 target and $63.00 stop-loss. The fundamental backdrop for energy remains challenged by rising supply from OPEC+, continued Russian exports despite sanctions, and political pressure from the Trump Administration for lower gasoline prices. Recent supply disruptions from Ukraine provide only temporary support.

Conversely, we maintain our bullish stance on gold with a $4,400 target and $3,850 stop-loss. The recent technical correction has improved the sustainability of the precious metals uptrend by allowing momentum indicators to reset from overbought levels. Federal Reserve policy uncertainty, negative real interest rates, and strong central bank demand support higher prices ahead.

For fixed income, we hold a bullish position on the iShares 20+ Year Treasury Bond ETF with a $93.00 target and $85.00 stop-loss. Despite the recent backup in yields following the Fed's November decision, we expect the ten-year Treasury yield to fall back below 4.00% as markets price in continued rate cuts. The resolution of the government shutdown should eventually allow economic data releases that confirm labor market weakness, supporting the Fed's dovish policy path.

Overall, our positioning balances conviction in long-term themes with tactical flexibility to navigate near-term volatility. We remain focused on AI infrastructure within technology, value-seeking consumer behavior in retail, and safe-haven positioning in precious metals. This combination provides diversification while maintaining exposure to what we view as the most compelling risk-reward opportunities in current markets.

What's Next?

We want to hear from you. Hit reply and tell us: What's your biggest investment challenge right now?

Whether it's timing entries, managing risk, or identifying the next major opportunity—we read every response and use your feedback to make our research even more valuable.

Here's to your financial success,

Sincerely,

7AM Team

IMPORTANT DISCLAIMER

This report represents analysis and opinion rather than investment advice or recommendations. All views expressed reflect our current thinking and may change as new information becomes available. Past performance does not guarantee future results.

Readers should conduct their own research and consult with qualified financial advisors before making investment decisions. Market conditions can change rapidly, and positions discussed may not be suitable for all investors depending on individual circumstances, risk tolerance, and investment objectives.

The information provided is believed to be accurate but is not guaranteed. We do not warrant the completeness or timeliness of information presented. Investing involves risk including possible loss of principal. There is no assurance that any investment strategy will achieve its objectives.