Executive Summery:

• S&P 500 closes at 6,827, down 0.77% for the week, experiencing heightened volatility around AI sector headlines despite reaching record highs on December 11th

• Federal Reserve delivers third rate cut of 2025 with 25 basis points reduction, but signals potential pause in January 2026 amid persistent inflation concerns

• Market remains in holding pattern between 6,550 and 6,920 since government shutdown ended, awaiting delayed economic data releases including November employment report

• AI infrastructure spending faces scrutiny as Oracle's cash flow pressures and Broadcom's margin compression concerns trigger sector-wide selloff

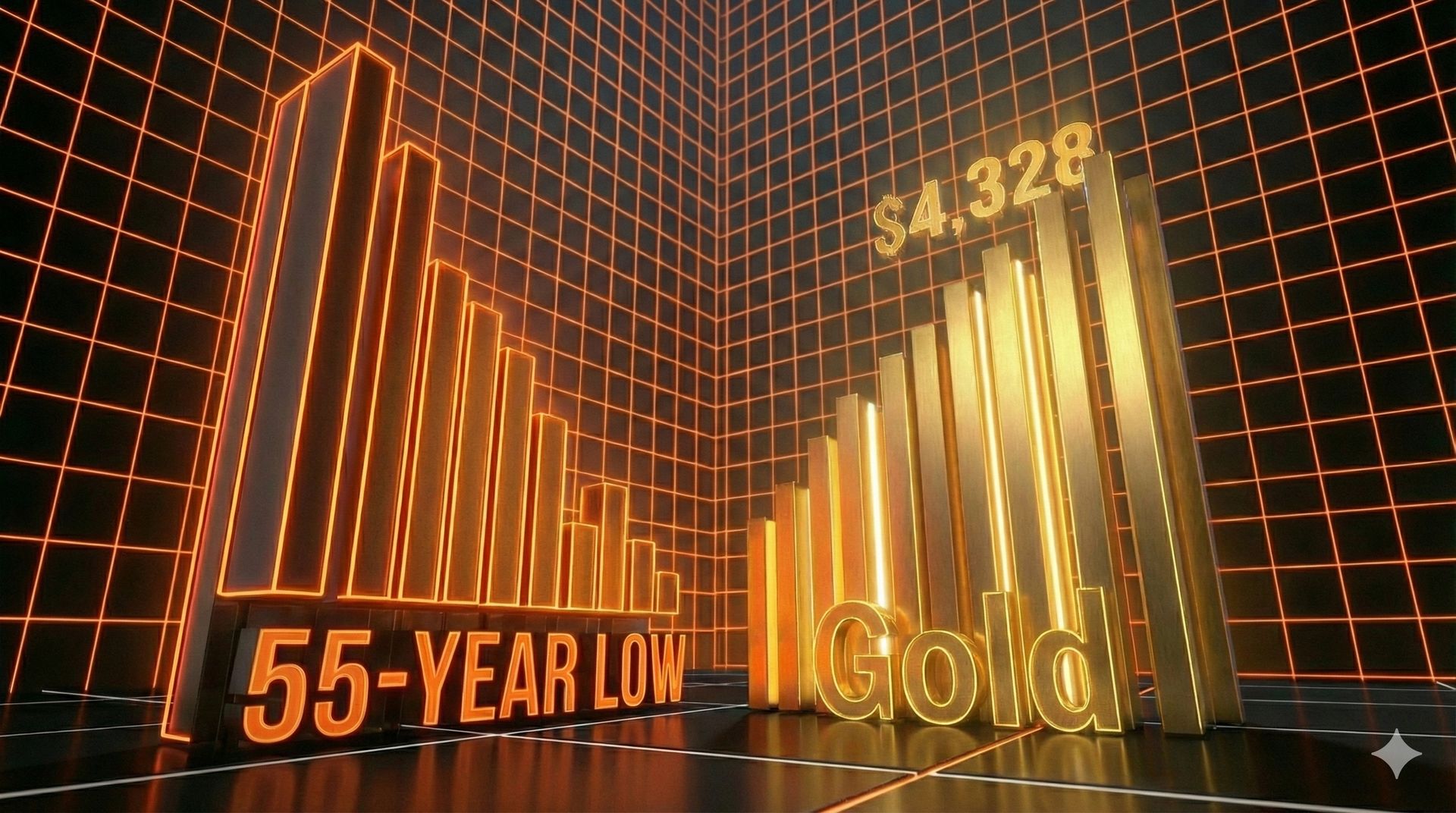

• Precious metals surge with gold up 2.44% to $4,328/oz while oil prices decline 4.48% to $57.52 on supply glut concerns and potential Russia-Ukraine peace negotiations

Previous Week:

Equity Market Performance

The S&P 500 experienced notable volatility during the week, declining 0.77% to close at 6,827, despite achieving a record closing high of 6,901 on December 11th. Markets demonstrated extreme sensitivity to AI-related headlines, with rapid sentiment swings creating dramatic intraday movements.

On Thursday, Broadcom exceeded earnings expectations but shares plummeted as much as 10% due to margin compression worries related to increased AI semiconductor revenue mix. The company's AI accelerator segment, while representing its fastest-growing business, incorporates high-bandwidth memory that necessitates passing through additional component costs, pressuring gross margins.

From a technical perspective, the index has established consistent higher highs and higher lows since bottoming on November 21st. The December 11th record close came with an intraday pullback to 6,800 support on December 12th, followed by a quick reversal above 6,850. This price action suggests active dip buying remains in force. The daily RSI holds near 55, well below overbought territory, while the daily top Bollinger Band has shifted higher to 6,985, establishing technical room for continued upside toward the 6,920 all-time high from October 29th.

Federal Reserve Policy Decision

The Federal Reserve delivered its third interest rate reduction of 2025, cutting rates by 25 basis points as widely anticipated. However, the decision carried significant cautionary signals about future policy direction. Most notably, three members voted against the reduction, marking the first such dissent since September 2019.

Fed Chair Powell's post-meeting commentary introduced considerable uncertainty regarding the December meeting trajectory. His statement that a further reduction remains far from a foregone conclusion represented a marked shift from previous guidance. Markets responded by repricing December rate cut probability from over 90% to approximately 65%.

Employment Data Signals

The extended government shutdown, lasting from October 1st through November 12th and ranking as the second-longest in U.S. history, created an unprecedented economic data vacuum. While September jobs reports remain unavailable, proprietary employment indicators suggest sharp September decline followed by meaningful October recovery.

The ADP employment report painted a troubling picture, showing the U.S. lost 32,000 private-sector jobs in November. This weakness typically emerges after economic peaks, raising recession concerns. However, initial jobless claims data tells a dramatically different story. Claims for the final November week fell to the second-lowest level since 1969, with the four-week moving average declining significantly from September levels.

Analyzing historical patterns, the recent 24,000 decline in average initial jobless claims over 91 days carries important implications. Over the past 60 years, such improvements have never occurred within five months of recession onset. Every instance appeared either during economic expansion or as recessions neared their end. This pattern strongly suggests we are not entering recession in 2025, contrary to widespread concerns.

AI Infrastructure Concerns

Several developments last week raised questions about AI infrastructure spending sustainability. Nvidia announced approval to sell H200 chips into China, potentially adding $25-30 billion in revenue. While seemingly positive, this development creates complications. Management has consistently emphasized being completely sold out across all product lines, with CEO Jensen Huang confirming demand won't catch up with supply for 12-18 months.

The question emerges: where will capacity come from to fulfill Chinese orders? Additionally, H200 sales into China carry 25% tariff surcharges that Nvidia must legally pay, directly impacting margins. The semiconductor sector rule remains straightforward: buy when margins expand, sell when margins contract. If Nvidia diverts capacity to serve China while absorbing tariff costs, margins face downside risk for the April 2026 quarter.

Oracle's earnings release exposed the most significant red flag among AI infrastructure providers. The hyperscaler spent $20 billion on capital expenditures while generating only $10 billion in cash flow from operations. To bridge this gap, Oracle sold $5 billion in marketable securities and borrowed an additional $18 billion. CFO Clay Magouyrk attempted reassurance by stating the company expects substantially less than the $100 billion some analysts project for completing buildouts, while emphasizing commitment to maintaining investment-grade debt rating.

Upcoming Week:

Market Outlook and Technical Setup

The S&P 500 has traded within a defined range between 6,550 and 6,920 throughout the government shutdown period and its aftermath. The market now stands at a critical juncture as delayed economic data releases beginning this week will either confirm expansion continuation or signal contraction onset.

The S&P 500 SPDR (SPY) has repeatedly attempted to break above $685 resistance, reaching near $690 during peak earnings season before encountering rejection. Three separate tests of $685 in recent weeks all failed, with the ETF selling off Friday after another rejection at this level. A sustained move above $685 would indicate a much larger rally developing. Conversely, failure to hold the $671 level, which has provided support throughout December. Particularly alongside continued Treasury yield curve steepening, would suggest the path of least resistance has shifted downward.

We believe near-term market swings represent noise within the broader uptrend. Dip buyers remain active, and we view emotional price swings as opportunities to add quality positions. The daily RSI near 55 provides substantial room before overbought conditions emerge, while the daily top Bollinger Band at 6,985 establishes a clear technical target for the next upward leg.

We maintain our view that sustained upside toward and above 6,900 appears likely this week. AI infrastructure demand remains robust despite recent concerns, trade relations between the U.S. and China continue improving with H200 chip sale approvals, and we expect dips will continue attracting buyers. Therefore, we remain constructive on the S&P 500 with a 7,000 target and 6,700 stop-loss.

Critical Economic Data Releases

This week marks the end of the substantial data blackout that has characterized markets since the government shutdown. A large backlog of economic reports including employment and inflation data will be released, potentially painting a clearer economic picture and helping the S&P 500 break out of its recent range.

The November employment report arrives on Tuesday and represents the most important release. This will be our first true look at the jobs market since September numbers, which were themselves delayed by approximately seven weeks. The consensus expects improvement from the weak ADP report, but considerable uncertainty remains given the data disruption.

October Retail Sales data will provide insight into consumer spending strength heading into the holiday season. November Consumer Price Index figures will inform inflation trajectory and Fed policy decisions. Initial Jobless Claims on Wednesday will offer additional labor market color. The December Empire Manufacturing and Philadelphia Fed surveys will round out the week's data, providing regional economic perspective.

The Treasury market reaction to this data deluge will prove particularly telling. Should investors continue favoring short-term Treasuries over long-term securities, causing further yield curve steepening from current levels, it would signal rising recession probability. Alternatively, if long-term yields decline relative to short-term rates, it would support the expansion continuation thesis suggested by improving jobless claims data.

Key Earnings Releases

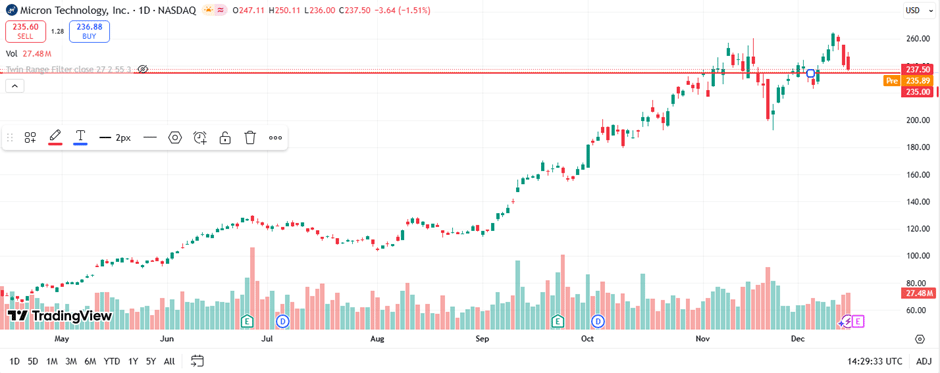

Several notable companies report earnings this week with potential to influence broader market direction. Micron Technology reports Wednesday after market close, representing a key bellwether for memory pricing and AI infrastructure demand. The company has been diverting capacity toward high-margin HBM production, with all 2026 HBM capacity already booked. This supply constraint has driven DRAM and NAND prices higher, benefiting Micron's margins.

The company guided first-quarter earnings between $3.60 and $3.90 per share, with consensus at the high end at $3.89. Multiple sources indicate higher average selling prices will likely lift results above previous expectations, with market expectations clustering around $4.00 per share. Since memory pricing isn't expected to decline next quarter, this implies upside to forward estimates as well, setting up a potential beat-and-raise scenario.

Nike reports Thursday after market close, with all attention focused on third-quarter guidance rather than second-quarter results. Earnings estimates bottomed in late October and have been trending higher since, though they still lean conservatively. The company indicated in its first-quarter report that fourth quarter fiscal 2025 would reflect the largest financial impact from cost reduction actions, with headwinds to revenue and gross margin expected to moderate thereafter.

Consensus earnings estimates suggest sequential decline from the first quarter, creating room for upside if margins continue improving as management suggested. One source expects Nike to beat estimates for the quarter but provide third-quarter guidance below current consensus. Another believes the company will begin showing sales inflection in the third quarter. The guidance will prove critical—when Nike has provided positive guidance historically.

Oil:

Price Action and Market Dynamics

WTI crude closed the week 4.48% lower at $57.52 per barrel, declining back to the bottom end of its recent trading range. Oil prices failed to hold the psychologically important $60 level despite briefly reclaiming it on December 5th. A prompt rejection at $60.50 led prices back below the key support level on December 8th, coinciding with rejection of approximately 55 resistance in the daily RSI.

The decline continued through the week, bringing crude into the $57.00 to $57.50 support zone. On December 11th and 12th, prices crossed below the daily bottom Bollinger Band at $57.40, while the daily RSI tested and held approximately 40 support. Despite the Federal Reserve's rate, a supportive factor for commodities—oil prices remained under significant pressure from multiple fundamental headwinds.

Supply Side Pressures

Supply-side dynamics continue weighing heavily on crude prices despite OPEC+ production management efforts. New data from OPEC+ indicated that world oil supply would match demand closely in 2026. This outlook contrasts with International Energy Agency projections but represents a more bearish view than earlier this year when OPEC saw demand outstripping supply.

Energy disruptions between Russia and Ukraine have been largely priced out of the market. The Trump Administration remains firmly committed to lower energy prices, creating an implicit ceiling on crude oil rallies. This political priority appears willing to encourage production increases and may resist meaningful upward price movements, representing a structural headwind that could cap rallies for an extended period.

On the supply disruption front, Venezuelan oil supply concerns have intensified following the U.S. tanker seizure. While this creates potential for reduced supply from Venezuela, it represents only one factor among many currently influencing the market. The net effect of all supply-side considerations continues tilting bearish despite these specific disruption risks.

Technical Outlook

From a technical perspective, WTI crude recently crossed below the daily bottom Bollinger Band at $57.40, with the daily RSI holding approximately 40 uptrend support. We believe a sustained move below the $55.00 to $57.00 technical demand zone is unlikely to hold, and this has shifted risk-to-reward back in favor of the bullish case.

We continue to believe a relief rally is necessary in oil prices. The technical picture has retreated back to the bottom end of the commodity's recent range, creating favorable entry points. This week, we look for an early move back toward $59.00 and watch the $60.50 high from December 5th as the key technical pivot point to reclaim.

Reclaiming $60.50 would open the path for the top end of the recent range at $62.00. With WTI crude back in the $57.00 to $57.50 support zone, a daily RSI at approximately 40, and a cross below $57.40, we expect the commodity to find support around current levels. Therefore, we maintain a constructive view on WTI crude with a $62.00 target and $54.00 stop-loss.

Metals:

Gold Market Overview

Gold prices for February delivery closed the week 2.44% higher at $4,328 per ounce, with the U.S. Dollar Index falling to its lowest level since October 17th. Silver prices extended their impressive rally to over 120% year-to-date gains. The surge in precious metals occurred despite continued economic data blackout and the Fed's hints that interest rate cuts would pause in January.

Markets are clearly pricing in a sustained period of higher than usual inflation, with the Fed's 2% inflation target appearing distant at best. On Friday, President Trump indicated he is leaning toward choosing either former Fed Governor Kevin Warsh or White House Economic Advisor Kevin Hassett as next Fed Chair. When asked about desired interest rate levels for next year, Trump responded "1% and maybe lower than that," signaling potential for dramatically different monetary policy direction.

Gold surged to a high of $4,388 on December 12th, crossing above the $4,356 daily top Bollinger Band with a brief move above 70 in the daily RSI. Following this surge, gold declined sharply into $4,286 before closing the week at $4,328. The pullback from overbought levels represents healthy consolidation rather than concerning weakness.

Fundamental Support Factors

The long-term fundamental picture for gold remains extremely strong across multiple dimensions. Central bank demand continues at historically elevated levels. Geopolitical tensions persist globally. Real interest rates remain in negative territory despite recent nominal rate increases. Additionally, the ongoing government shutdown aftereffects create uncertainty about economic data and fiscal policy—traditionally supportive factors for gold as a safe-haven asset.

The recent strength in the U.S. Dollar, while creating near-term pressure on gold prices, appears unsustainable from a technical perspective. The Dollar Index has reached a daily RSI of approximately 67 and crossed above its daily top Bollinger Band at 99.67, indicating overbought conditions. Without sufficient fundamental support for a sustained Dollar rally, we expect this strength to prove temporary, removing a key headwind for gold.

We believe gold will only further solidify itself as the global safe haven asset as government bond issuances remain out of control and cryptocurrency markets continue experiencing extreme volatility. The combination of fiscal excess, monetary policy uncertainty, and geopolitical risk creates an exceptionally favorable backdrop for precious metals ownership.

Technical Analysis and Outlook

Gold's technical correction has improved the sustainability of the uptrend. The pullback has allowed crucial technical indicators to reset to healthier levels. The daily RSI declined from overbought and Bollinger Band has shifted to $3,877 its highest level on record suggesting long-term support levels continue rising.

The combination of improved technical positioning, strong fundamental support, and the likely temporary nature of Dollar strength creates a compelling setup for renewed gains in precious metals.

While we have stepped to the sidelines following our exit near the recent highs, we watch the $4,250-$4,300 area as key support where we may look to re-establish our positive view. The fundamental backdrop supports significantly higher prices over the medium term, and technical consolidation phases like the current one typically provide attractive entry opportunities for those with longer time horizons.

Stock Picks

Micron Technology (MU) - Favorable Setup

Entry Consideration: Monitor $235 support level; consider positions on sustained hold above this level with stop below $230

Company Overview

Micron Technology represents a compelling opportunity in the memory semiconductor space as AI infrastructure demand drives pricing power across DRAM and NAND markets. The company reports first quarter fiscal 2026 earnings on Wednesday, December 17th after market close, with consensus expectations calling for earnings of $3.89 per share on revenue of $12.54 billion.

The fundamental story centers on Micron's successful capacity shift toward high-bandwidth memory (HBM) production for AI applications. The company has been diverting manufacturing capacity to focus on building higher-margin HBM, and current capacity is fully booked through 2026. CEO Sanjay Mehrotra indicated last quarter that the company expects to conclude agreements on HBM4 supply as well as all of 2026 HBM supply within the next few months.

This supply constraint has created a favorable pricing environment across all memory types. With HBM capacity fully committed through next year, Micron has limited availability for other memory products, pushing prices higher for DRAM and NAND. One source believes this will continue helping drive both DRAM and NAND prices higher this quarter and for the next three quarters.

Growth Catalysts and Pricing Power

Micron functions more as a commodity stock than a pure technology play—the company's stock tends to move with the price of the memory products it sells, directly factoring into both revenue and margins. With HBM booked through 2026, sources believe this will continue pushing both DRAM and NAND prices higher this quarter and for the next three quarters. This creates a powerful tailwind for both earnings and stock price appreciation.

The company guided first-quarter earnings between $3.60 and $3.90 per share, with consensus at the high end at $3.89. Multiple sources expect higher average selling prices to lift results above previous expectations. Market expectations have coalesced around $4.00 per share - above the high end of management guidance.

Technical Setup and Risk Management

The stock was positioned favorably ahead of earnings but gave up the key $250 level quickly. There remains support at $235, though this level appears vulnerable. The chart shows net margins over the past seven years including next two quarters of estimates, with the stock price tracking margin expansion and contraction closely.

Red lines on the historical chart highlight when margins fell during quarters, correlating with stock selloffs from late 2021 to late 2022. The general rule for semiconductor stocks holds: buy when margins expand, sell when margins contract. The current setup suggests margins should continue expanding, supporting higher stock prices alongside commodity price strength.

The key technical level to watch is $235 support. A sustained hold above this level would maintain the constructive setup, while a breakdown below could signal deeper correction. The favorable fundamental backdrop of rising memory prices and fully booked HBM capacity suggests any weakness may represent buying opportunity rather than change in trend.

We view Micron as a commodity play benefiting from supply constraints in a critical input for AI infrastructure. The fully booked HBM capacity through 2026, combined with rising prices across all memory types, creates a powerful earnings catalyst. Any pullback toward support levels may offer attractive entry points for those seeking exposure to the memory semiconductor cycle.

Closing:

Current Portfolio Positioning

We maintain a net long position in the overall stock market, reflecting our view that the current environment supports further equity gains despite near-term volatility. The combination of improving labor market indicators, accommodative Federal Reserve policy despite recent hawkish rhetoric, and substantial corporate cash flow generation supports our constructive outlook.

Trading Strategy and Risk Management

For the S&P 500, we maintain our constructive stance with a 7,000 target and 6,700 stop-loss. The recent consolidation between 6,550 and 6,920 has created a healthy technical base for the next leg higher. Key near-term support at 6,800 held during last week's pullback, while the daily RSI near 55 provides substantial room before overbought conditions emerge. The daily top Bollinger Band at 6,985 establishes a clear technical target for sustained moves above current resistance.

We view AI-related headline volatility as noise within the broader uptrend and continue believing dips will be bought. Near-term swings in sentiment create opportunities to add to quality positions at attractive prices. The $685 level in the S&P 500 SPDR represents key resistance—sustained moves above this level would signal much larger rally developing, while failure to hold $671 support would require reassessment of our constructive view.

In commodities, we maintain a constructive view on WTI crude with a $62.00 target and $54.00 stop-loss. The pullback to the $57.00-$57.50 support zone, combined with oversold technical indicators, has shifted risk-to-reward in favor of the bullish case. We expect relief rally development toward the $60.00-$62.00 range as technical conditions improve.

For precious metals, we remain on the sidelines following our exit near recent highs but watch the $4,250-$4,300 area in gold as potential re-entry point. The fundamental case for gold ownership remains robust across multiple dimensions, and technical consolidation typically provides attractive entry opportunities. We expect gold to solidify its position as the global safe haven asset as fiscal and monetary policy uncertainty persists.

Overall, our positioning reflects confidence in continued economic expansion supported by improving labor market indicators, substantial corporate earnings power, and accommodative financial conditions despite Federal Reserve rhetoric. We remain focused on high-quality companies benefiting from multi-year structural trends while maintaining tactical positions in other asset classes to capture favorable risk-reward opportunities. The coming week's economic data releases will provide important confirmation or challenge to our expansion continuation thesis.

What's Next?

We want to hear from you. Hit reply and tell us: What's your biggest investment challenge right now?

Whether it's timing entries, managing risk, or identifying the next major opportunity—we read every response and use your feedback to make our research even more valuable.

Here's to your financial success,

Sincerely,

7AM Team

IMPORTANT DISCLAIMER

This report represents analysis and opinion rather than investment advice or recommendations. All views expressed reflect our current thinking and may change as new information becomes available. Past performance does not guarantee future results.

Readers should conduct their own research and consult with qualified financial advisors before making investment decisions. Market conditions can change rapidly, and positions discussed may not be suitable for all investors depending on individual circumstances, risk tolerance, and investment objectives.

The information provided is believed to be accurate but is not guaranteed. We do not warrant the completeness or timeliness of information presented. Investing involves risk including possible loss of principal. There is no assurance that any investment strategy will achieve its objectives.