Executive Summery:

• The S&P 500 ended 2025 with a gain of 16.39%, marking its third consecutive year of double digit returns above 15%, and closed the week at 6,858

• Markets traded in a 6800 to 6950 technical range following the December Federal Reserve meeting that showed a tight split between officials over the December interest rate cuts

• The yield curve steepened following October payroll losses of 105,000 jobs and November gains of 64,000 jobs, reaching warning levels historically associated with recessions

• Employment data shows increased hiring in December with employment indicators at levels historically producing an average of 237,000 new jobs

• Financial sector positions increased with 162 companies reporting earnings in the next four weeks showing total short interest at three year highs, with 30% being financials

• Regional Banks led market performance last quarter with 90% of holdings rising since earnings and 87% outperforming the S&P 500

Previous Week:

Equity Market Performance

The S&P 500 closed the week lower by 1.03% at 6,858 but concluded 2025 with an impressive gain of 16.39%. This marked the third consecutive year the index posted double digit returns above 15%. Technology stocks led the broader market to sharp gains as participants continued to invest in AI infrastructure names. The Nasdaq Composite jumped more than 20% last year while the Dow climbed around 13%, with all three major benchmarks reaching record highs during 2025.

Given the shortened trading week, economic data was relatively sparse. Markets have been trading within a range that coincided with the start of the government shutdown, which has now exceeded 30 days and ranks as the second longest in US history. The technical picture improved significantly as the index bounced off 6,800 support following the Fed decision. Key technical levels include the daily RSI finding support at 50 and the daily top Bollinger Band at 6,915.

We believe the themes driving markets in 2025 will persist through at least early 2026, and the AI Revolution is positioned for further historic stock market gains. The S&P 500 has been trading in the 6800 to 6950 technical range in what appears to be textbook technical consolidation.

Economic Data and Employment

On Friday, S&P Global data showed that US factory activity slowed down in December. The purchase manager index posted a reading of 51.8 for the month, down slightly from 52.2 in December, further reinforcing recent trends of US manufacturing experiencing some pressure. On the flip side, November pending home sales surged 3.35%, well above expectations of 1.0%, and initial jobless claims came in at 199,000, below expectations of 219,000.

The biggest data point was the payrolls report, which included numbers for both October and November. The October numbers showed a loss of 105,000 jobs, but the November numbers showed an increase of 64,000 jobs, which technically was an upside surprise. The yield curve subsequently steepened on the news, which is a significant warning. Over the past 50 years, the yield curve has never reached this level after being inverted without either already being in a recession or the stock market peaking before the recession.

However, we are not seeing the reaction in other areas that we would expect if heading into a recession. Junk Bonds, as measured by the Bloomberg High Yield Bond ETF, have held steady following the jobs report. Other leading indicators, such as Durable Goods, Retail Sales, and Industrial Production, all improved in the latest numbers.

Employment indicators show increased hiring in December, and over the past 20 years, when the index reached current levels, the number of new jobs increased to an average of 237,000 from 168,700 the prior month. The current consensus estimate is for 55,000 new jobs in December, a decrease from November's numbers. However, the data suggests improving jobs numbers rather than weaker ones.

Federal Reserve Policy

On Wednesday, the December Fed meeting minutes showed a tight split between officials over the December interest rate cuts. With respect to the extent and timing of additional adjustments to the target range for the federal funds rate, some participants suggested that it would likely be appropriate to keep the target range unchanged for some time after the December rate cut.

We believe interest rate cuts will pause at the January 2026 Fed meeting and likely not resume until March or later. Most participants judged that further downward adjustments to the target range for the federal funds rate would likely be appropriate if inflation declined over time as expected. Fed officials expressed a variety of opinions during the December 10th Fed meeting, according to the minutes, which resulted in the Fed cutting rates by 25 basis points in a 9 to 3 vote, with the most dissents since 2019.

Upcoming Week:

Market Outlook and Technical Setup

On December 31st and January 2nd, the S&P 500 fell into 6,840 uptrend support which has served as a key support level for the index. This came with a bounce off approximately 50 uptrend support in the daily RSI while the daily top and bottom Bollinger Bands have remained relatively flat at 6,960 and 6,755, respectively.

We believe a higher low is set to form in the 6800 to 6850 range as technical consolidation nears its end. This will open the path for a break above the 6,946 record high on December 26th and ultimately pave the way for a push into our long time target of 7,000 for the S&P 500. To the downside, we watch the 6,720 higher low from December 17th as our line in the sand as a break below that level would invalidate the near term uptrend.

The trend remains higher despite the more recent sideways movement. A move that holds above 6,900 for the S&P 500 after multiple rejections, or above 689 to 690 for SPY, would signal more upside with a near term upside target to 730. A move below 671 would warn that we are wrong.

Employment Outlook

This week we will get the jobs report once again, and if the economy has peaked, we should see it in the employment numbers. However, that does not seem likely to happen this month. While we do not expect the data to show 200,000 or more new jobs, it does suggest improving jobs numbers rather than weaker ones.

Looking at historical data, if you exclude the COVID lockdowns, there has only been one recession during the period since 2004. The 2008 to 2009 recession started in December 2007, and the market peaked in October prior to that. From November 2007 until February 2010, employment indicators were below current levels. That suggests we are not entering a recession now, but it does not mean a recession is not coming.

Our view remains the same. If we are entering a recessionary bear market, we will have time to respond accordingly. In the meantime, the trend remains higher.

Financial Sector Dynamics

We have gone from one of the most restrictive Administrations to a very pro business Administration. Since then, the Fed has reduced leverage ratios for large banks, making it easier to put capital to work. Examination requirements for community banks have been reduced, and capital requirements have been reduced as well. Going into 2026, there are discussions of rolling back many of the post Financial Crisis rules that are viewed as overly restrictive.

There appears to be a large bet that consumers will be unable to repay their debts, and loan loss provisions will increase. There are 162 companies reporting earnings in the next four weeks that have total short interest at three year highs, and 30% of them are Financials. As long as the consumer can continue to make their payments, earnings should continue to improve. If the consumer holds steady, short sellers are at risk of being squeezed out of their positions.

Regional Banks have been among the market leaders since reporting earnings last quarter, even as participants pressed their short positions. 90% of the stocks in the Regional Banks ETF are up since reporting earnings last quarter, and 87% of them have outperformed the S&P 500 during that period. The S&P Bank SPDR has been similar, with 88% showing positive performance and 81% outperforming the S&P 500.

The Russell 2000 is worth noting as well. Many think about software companies with no earnings when considering the Russell 2000, but the Regional Bank ETF has 142 companies, and 111 of them are in the Russell 2000. Therefore, as the Russell 2000 holds above its 2021 and 2024 peaks, the expectation is for more upside.

Sector Performance

Late last week, the Industrials broke to new highs. This follows the Transportation stocks, which broke out a month ago and have been trading sideways since. This is a Dow Theory confirmation of a bull market and supports maintaining long positions ahead of earnings.

Participants remain modestly defensive, but there was a pickup in cyclicals. We believe the main story here is the low sentiment in Technology stocks while earnings estimates continue to get revised higher.

Oil:

Price Action and Market Dynamics

WTI crude closed the week higher by 0.70% at 57.31 dollars per barrel but posted its largest annual decline since 2020. The Brent and WTI benchmarks recorded annual losses of nearly 20% in 2025, the steepest since 2020, as concerns about oversupply and tariffs outweighed geopolitical risks. It was the third straight year of losses for Brent, the longest such streak on record.

Despite a brief recovery following the US China trade agreement, oil prices remain under significant pressure from multiple fundamental headwinds. Rallies in oil prices continued to be sold with price trading around four year lows. Markets continue to discount the importance of geopolitical tensions as President Trump largely seeks to contain and end the crises as they escalate.

Supply Side Pressures

President Trump continued to increase pressure on Venezuelan President Nicolas Maduro with the new imposition of sanctions on four companies and associated oil tankers operating in Venezuela's oil sector. On top of this, President Trump threatened to take further action in Iran and a crisis between OPEC producers Saudi Arabia and the United Arab Emirates over Yemen has deepened, all of which have threatened supply.

Supply side dynamics continue to weigh heavily on crude prices despite OPEC production management efforts. Information suggests Saudi Arabia may reduce its December crude price for Asian buyers to multi month lows due to ample supplies. This pricing action signals weakening demand from key Asian markets and intensifying competition among producers.

Additionally, Russian oil exports to top buyers China and India continue despite US sanctions. New information suggests OPEC is leaning toward a modest output boost in December. The eight OPEC members implementing production increases have already added more than 2.7 million barrels per day, approximately 2.5% of global supply. This incremental supply is entering a market already dealing with demand concerns.

Technical Outlook

WTI crude rose as high as 58.88 dollars on December 26th which marks the most recent lower high for the commodity. Since then, prices have retreated to a low of 56.60 dollars on January 2nd, the daily RSI is nearing 45 uptrend support, and the daily top and bottom Bollinger Bands have shifted down to 60.11 dollars and 55.35 dollars, respectively.

We believe a lot of the bear case has been priced in and oil prices are nearing the bottom end of their range. Prices are currently in a middle zone with the bottom end of the range at 55.00 dollars, which would be a much more favorable spot to consider bullish positioning again.

Metals:

Gold Market Overview

Gold prices closed the week lower by 4.43% at 4,339 dollars per ounce but officially posted a 64% gain in 2025, its biggest annual gain since 1979, driven by Fed rate cuts, geopolitical tensions, strong central bank buying, and rising ETF holdings. Silver posted its best year in history, rising 147% in 2025, driven by its increasingly critical use in technology, supply shortages, and low inventories globally.

The decline came as Fed Chair Powell pushed back against market expectations for a guaranteed December rate cut, reducing the perceived probability from over 90% to approximately 65%. This shift in sentiment, combined with a rebound in the US Dollar Index to fresh three month highs near 100, created near term headwinds for gold. However, we view these moves as primarily technical adjustments rather than fundamental changes to the bullish thesis for precious metals.

Fundamental Support Factors

Our strongly bullish view of precious metals for the entirety of 2025 will carry over into 2026, and we believe conditions are ripe for sustained record highs in gold prices. The fundamental case for gold ownership remains robust across multiple dimensions. Central bank demand continues at historically elevated levels, geopolitical tensions persist globally, and real interest rates remain in negative territory despite recent nominal rate increases.

Additionally, the ongoing government shutdown creates uncertainty about economic data and fiscal policy, traditionally supportive factors for gold as a safe haven asset. The US Dollar Index rejected 98.50 resistance twice last week and appears to be setting up for its next lower high and lower low, further supporting gold prices. The Dollar Index posted its worst year since 2017 in 2025 and we believe that the downtrend will persist.

The recent strength in the US Dollar, while creating near term pressure on gold prices, appears unsustainable from a technical perspective. The Dollar Index has reached a daily RSI of approximately 67 and crossed above its daily top Bollinger Band at 99.67, indicating overbought conditions. Without sufficient fundamental support for a sustained Dollar rally, we expect this strength to prove temporary, removing a key headwind for gold.

Technical Analysis and Outlook

The most recent record high in gold futures came on December 26th at 4,584 dollars, which also coincided with silver's move above a record 80 dollars per ounce. This came with a sharp cross above the daily top Bollinger Band and a break above 80 in the daily RSI, both of which signaled severely overbought territory.

The technical correction has actually improved the sustainability of the uptrend. The pullback has allowed crucial technical indicators to reset to healthier levels. The daily RSI has declined from overbought territory to approximately 51, creating substantial room for renewed upside. Meanwhile, the daily bottom Bollinger Band has shifted to its highest level on record, suggesting that long term support levels continue to rise.

We see the 4,250 to 4,350 dollar range as a solid support zone to increase bullish exposure and target a rebound toward new record highs in early 2026. The combination of improved technical positioning, strong fundamental support, and the likely temporary nature of Dollar strength creates a compelling setup for renewed gains in precious metals. We believe gold can see 5,000 dollars in 2026.

Stock Picks

Penguin Solutions Corporation (PENG)

Company Overview

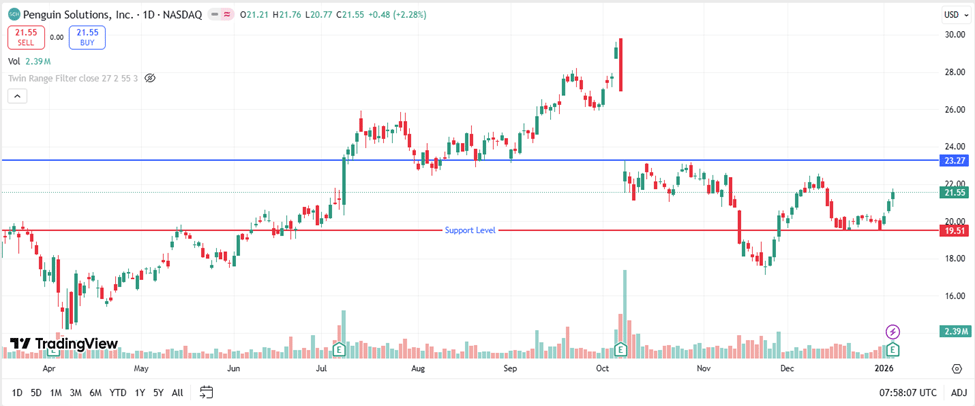

It is a light week for earnings, and it has been about three weeks since we have had any hard data points. Most of the companies reporting this week are light on coverage, leaving us with limited information to analyze. Penguin Solutions is an AI name that had a large gap lower on heavy volume last quarter, which shifted sentiment from perhaps being excessively bullish to now being bearish.

This may have been a precursor to the volatility we have seen in the entire AI space over the past quarter. If so, then how it reacts to earnings will be our first look into what to expect for upcoming AI earnings releases. The company is scheduled to report first quarter November 2025 earnings on Tuesday, January 6th after market close. Consensus expectations call for EPS of 0.52 dollars on revenue of 337.57 million dollars.

Growth Catalysts

Industry commentary suggests expectations for the company to report a beat and raise for the quarter. That is something the company has only done once before. In that instance, the stock opened lower by 1.4% on the news, then closed 12.1% above the open and 17.9% higher by the end of the week.

After gapping to 22.50 dollars last quarter and holding there for most of October, and then again in December, the stock likely needs to hold above 22.50 dollars to show it can resume going higher and fill the October earnings gap. The current market is expecting the company to deliver positive results that could shift sentiment back in a more constructive direction.

Technical Setup

From a technical perspective, Penguin Solutions shows interesting characteristics heading into the earnings release. The stock has consolidated after its October decline, forming what appears to be a base in the 22 to 24 dollar range. This consolidation has allowed technical indicators to normalize after the sharp selloff that followed last quarter's report.

We believe analysts think the market is going to respond positively if the company can deliver on expectations for a beat and raise. The key technical level to watch is 22.50 dollars as support. A hold above this level combined with positive earnings results could signal that the worst of the selling pressure is behind the stock and that accumulation is beginning to occur at these levels.

Closing:

Current Portfolio Positioning

We maintain a net long position in the overall stock market, reflecting our constructive outlook for equities in the current environment. We believe the combination of strong corporate earnings, accommodative Federal Reserve policy despite recent hawkish rhetoric, and robust technology sector capital expenditure plans supports further upside in major indices.

Within the equity portfolio, we hold a long position in Aehr Test Systems. This holding reflects our conviction in the sustainability of semiconductor infrastructure spending and the companies positioned to benefit from this multi year capital expenditure cycle. We have held this position from last summer and are willing to maintain it based on the expectation that the pipeline is going to materialize into new customers.

Strategic Rationale

The company makes test systems to stabilize semiconductor chips during manufacturing. Total semiconductor sales are expected to increase 29% in 2026 to reach one trillion dollars. For years, Aehr focused on silicon carbide for EVs and solar, but the industry became oversupplied and sales slowed, leaving the company struggling. This forced a refocus, and it now has burn in test systems for AI GPUs, as well as test systems for hard drives, HBM, and NAND, all of which are in short supply. This has resulted in many potential customers and comes just as the company is seeing a return to growth in EV and solar.

While we might still be a quarter away from finding out for sure, this is the quarter we have been expecting to see early wins, with a pickup in the next couple of quarters. The wins are not going to translate into sales anytime soon, and there is a lot of work that needs to be done to actually ramp a customer to be one year out.

This quarter might not be the time for the large production order, but we should expect to hear enthusiasm. Either way, unless the company changes its story, weakness should likely be considered as a potential opportunity ahead of the large production order coming down the road. For the near term trade, there are now enough technical touches for 20 dollars to be support, and for a move above 25 dollars to signal a breakout.

Trading Strategy and Risk Management

For the S&P 500, we maintain our outlook for the index with an expectation of a move toward 7,000. The recent pullback to 6,800 following the Fed decision created what we view as a favorable technical setup, with key support levels holding and momentum indicators resetting to healthier levels. We continue to view consolidation periods as healthy for the overall uptrend rather than signals of weakness.

In commodities, oil prices remain in a challenging fundamental environment despite geopolitical tensions. We are watching for a move toward 55 dollars which could present better entry opportunities. Natural gas is experiencing uncertainty related to winter weather patterns, and we are monitoring for technical setups that could offer favorable entry points.

For precious metals, we view the recent technical correction in gold as healthy and believe the 4,250 to 4,350 dollar range presents an attractive zone for positioning. The fundamental backdrop for gold remains supportive with central bank purchases at elevated levels, geopolitical uncertainties, and the Dollar likely having peaked in the near term.

Overall, our positioning reflects confidence in the continuation of the equity bull market, supported by strong corporate fundamentals and technical setups following recent consolidation. We remain focused on themes within technology and semiconductors while maintaining tactical positions in other asset classes to capture what we view as favorable opportunities.

What's Next?

We want to hear from you. Hit reply and tell us: What's your biggest investment challenge right now?

Whether it's timing entries, managing risk, or identifying the next major opportunity—we read every response and use your feedback to make our research even more valuable.

Here's to your financial success,

Sincerely,

7AM Team

IMPORTANT DISCLAIMER

This report represents analysis and opinion rather than investment advice or recommendations. All views expressed reflect our current thinking and may change as new information becomes available. Past performance does not guarantee future results.

Readers should conduct their own research and consult with qualified financial advisors before making investment decisions. Market conditions can change rapidly, and positions discussed may not be suitable for all investors depending on individual circumstances, risk tolerance, and investment objectives.

The information provided is believed to be accurate but is not guaranteed. We do not warrant the completeness or timeliness of information presented. Investing involves risk including possible loss of principal. There is no assurance that any investment strategy will achieve its objectives.