Executive Summery:

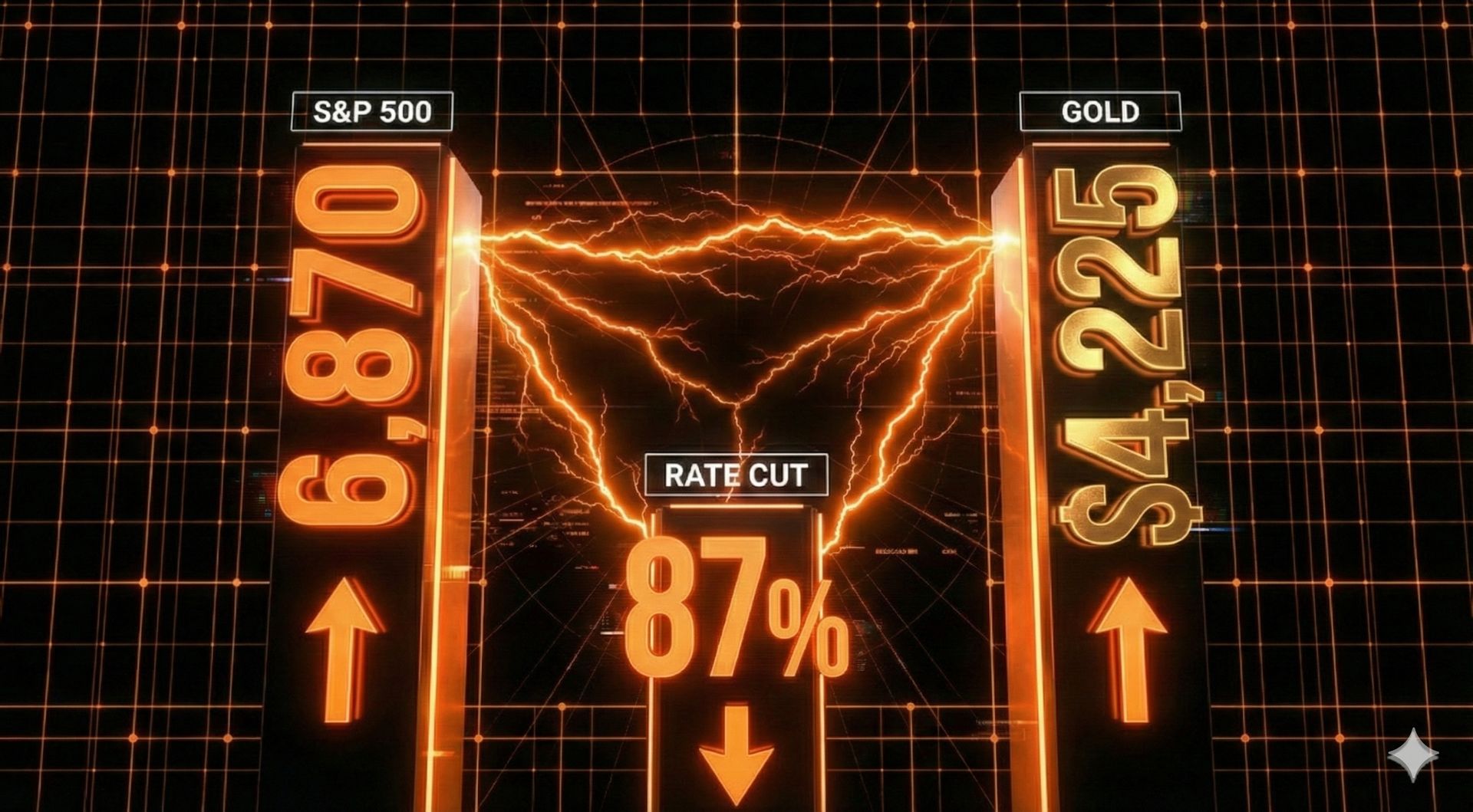

• S&P 500 advances 0.31% to 6,870 with markets pricing in 87% probability of 25 basis point rate cut at December 10th Fed meeting

• Core PCE inflation for September rises 2.8% year-over-year, slightly below expectations, while labor market shows signs of weakness

• ADP private payrolls unexpectedly decline by 32,000 jobs in November, marking concerning trend for employment

• December guidance announcements reach best first-week levels in 25 years of data, suggesting continued earnings strength

• Technology sector earnings receive upward revisions as AI infrastructure spending accelerates across major cloud providers

• Initial jobless claims hit historic lows at 191,000, creating contradictory signal against ADP employment data

Previous Week:

Equity Market Performance

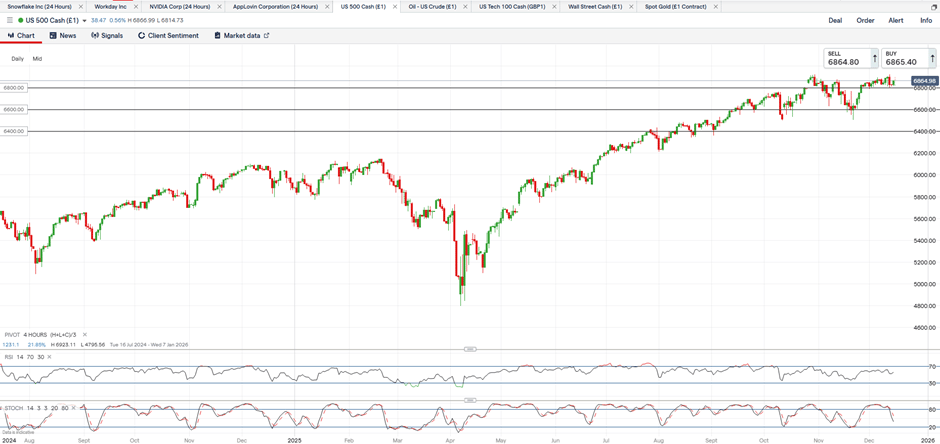

The S&P 500 posted a modest gain of 0.31% last week, closing at 6,870, extending a two-week rally that has positioned the index just one percent away from new record highs. Markets demonstrated resilience as they processed fresh economic data following the record-long government shutdown. The technical picture improved significantly as the index formed a higher high, rising into 6,895 on Friday.

The advance came alongside a bounce off approximately 55 support in the daily RSI, suggesting renewed buying interest. The daily top Bollinger Band shifted higher to 6,955, while the RSI remains roughly 10 points below overbought levels. We have also seen the daily bottom Bollinger Band flatten out at 6,563, which is another sign that the downward momentum seen in November has been reversed.

Market participants are increasingly confident that the Federal Reserve will cut interest rates by 25 basis points at their December 10th meeting, with pricing now reflecting an 87% probability. This expectation is being driven by a dual narrative: inflation remains moderately above the 2% target, closer to 3% according to most metrics, but the labor market is showing unmistakable signs of weakening.

Employment and Economic Data

Economic data continues to return after the extended government shutdown, but signals remain mixed and at times contradictory. The most concerning development came from ADP private payrolls data, which showed an unexpected decline of 32,000 jobs in November. Markets had anticipated a modest gain of 10,000 jobs. The weakness was concentrated among small businesses with fewer than 40 employees, mostly in the business services industry.

Over the past six months, ADP data reveals that private employers have added only 64,000 employees total, with negative numbers appearing in four of the past six months. The last time we saw similar patterns from ADP outside of a recession was in 2007, when three of the four months prior to the official recession start showed contracting numbers. This creates a concerning parallel that markets are closely monitoring.

However, initial jobless claims painted a dramatically different picture. Claims came in at just 191,000 for the latest week, the lowest reading since the third week of September 2022 when we saw 189,000 claims. In fact, looking back further, you have to go all the way to 1969 to find a week with fewer than 191,000 new jobless claims. While this number may be somewhat affected by the Thanksgiving holiday, the four-week moving average also dropped significantly.

The four-week average decline of 9,500 is particularly noteworthy from a historical perspective. Over the past 50 years, when the S&P 500 was purchased following a drop in the four-week average of 9,500 or more, returns averaged 1.04% over the following month. This compares favorably to just 0.6% average gains on all other dates.

What makes these jobless claims even more significant is their timing relative to economic cycles. Prior to 2020, we would periodically see such dramatic drops in jobless claims, but there were several concentrated weeks in April through July of 2009 as the Financial Crisis was ending and a new cycle was beginning. Conversely, there were no such drops in jobless claims in 2007 as the economy headed into recession.

The pattern is consistent across previous recessions: there wasn't a single case in the past 56 years of jobless claims data in which the four-week moving average fell by 9,500 or more in the months leading up to a recession. Furthermore, it seldom occurred during recessions. On the vast majority of occasions when jobless claims fell by similar amounts, we were in the recovery phase following a recession. This historical context suggests there is no near-term recession on the horizon, despite the concerning ADP employment data.

Inflation and Consumer Data

The Commerce Department released September PCE inflation data, showing Core PCE rose 2.8% year-over-year, slightly lower than the 2.9% expected. The monthly Core PCE increase of 0.2% came in line with expectations. Headline PCE also showed 2.8% inflation year-over-year, matching estimates for both monthly and annual readings.

The University of Michigan's consumer survey showed that both near and longer-term sentiment came in higher than expected for December. This improvement in consumer confidence occurs against a backdrop of persistent inflation concerns and labor market uncertainty, suggesting consumers maintain optimism about the economic outlook despite recent volatility.

Corporate Guidance Trends

The first week of December produced a remarkably strong slate of corporate guidance announcements. Companies issuing positive guidance during the first seven days of December reached the highest level in 25 years of data. Out of 70 total guidance announcements, 26 were positive and only 6 were negative, yielding a net positive ratio of 28.8%.

This pattern holds significant historical importance. Positive guidance announcements during the first week of December tend to follow recessions rather than precede them. The first week of December had more negative announcements than positive during the dot-com bubble through the end of the Great Recession. However, the first December after the 2007-2009 recession showed more positive than negative announcements.

Historical performance data supports bullish positioning following strong December guidance. When there were more positive guidance announcements than negative, the S&P 500 averaged a gain of 1.0% over the following month. This compares to just 0.5% gains (or a loss of 0.1% excluding 2008's anomalous results) when negative announcements dominated.

Upcoming Week:

Federal Reserve Policy Decision

All attention this week turns to the Federal Reserve's December 10th policy meeting. Markets have priced in an 87% probability of a 25 basis point interest rate cut, up from earlier expectations. The central question is not whether the Fed will cut, but rather what guidance they will provide for 2026 policy trajectory.

We believe the Fed will cut interest rates by 25 basis points into one of the hottest stock markets of all time, amid one of the biggest technological revolutions we have witnessed. The justification will center on Main Street feeling the pain of a weak labor market. As long as the perceived effects of the labor market side of their dual mandate remain weaker in magnitude than elevated inflation, the Fed will continue to cut interest rates.

This dynamic creates what we view as a highly supportive environment for equity markets. The Fed is essentially choosing to prioritize employment concerns over inflation that continues running above their 2% target. This will likely supercharge the rally in equities, further support inflation remaining elevated, and continue broadening the wealth gap between asset owners and wage earners.

However, significant uncertainty surrounds the Fed's longer-term outlook. With questions about who will be Fed Chair and general macroeconomic volatility ahead, we don't expect much of a concrete policy roadmap beyond the immediate December decision. The ongoing government shutdown's impact on economic data availability adds another layer of complexity to the Fed's decision-making process.

Market Outlook and Technical Setup

The technical setup for the S&P 500 appears highly constructive following last week's advance. The index is positioned just one percent below the all-time high of 6,920 reached on October 29th. The recent pullback and consolidation has allowed technical indicators to reset to healthier levels, creating what we view as a favorable entry point for further upside.

Key technical levels support continued momentum. The daily top Bollinger Band now sits at 6,955, providing a near-term upside target. The daily RSI has held approximately 55 support and remains roughly 10 points below overbought levels, suggesting substantial room for additional gains. Most importantly, the daily bottom Bollinger Band has flattened out at 6,563, its highest level on record, indicating that long-term support levels continue to rise.

We expect a sustained move above the 6,900 pivot point this week to open the path toward new record highs. The combination of improved technical positioning, strong fundamental support from corporate earnings, and the likely continuation of accommodative Fed policy creates a compelling setup for renewed gains. Our base case sees the S&P 500 hitting 7,000 for the first time in history in the coming weeks.

AI Infrastructure Spending Outlook

Technology sector earnings continue receiving upward revisions as AI infrastructure spending accelerates. Major cloud providers have announced massive capital expenditure plans that support continued strength in AI-related stocks. This spending cycle shows no signs of slowing, with several indicators pointing toward acceleration into 2026 and 2027.

Recent commentary from Marvell Technology management provides insight into the timeline of AI infrastructure buildout. Management indicated seeing robust demand signals and strong bookings across their entire portfolio, positioning them for strong growth in fiscal 2027 and even faster growth in fiscal 2028. Customers are planning to add substantial AI capacity over the next several years and are partnering closely on long-term technology roadmaps and coordinated capacity planning.

The company expects their data center revenue growth in fiscal 2028 to accelerate meaningfully above the 25% growth they anticipate in fiscal 2027. Management emphasized they have strong backlog coverage and expressed confidence in their outlook, noting that growth will really build in the following year. Until there are signs that orders are being canceled, the assumption is that growth will continue to accelerate into 2028, which supports continued strength heading into 2027.

Valuation Context

While overall market valuations are elevated, AI infrastructure stocks are nowhere near the rich valuations seen during the dot-com bubble, and market sentiment isn't nearly as enthusiastic as at other market peaks. There is currently little evidence that we are halfway through the CapEx boom, and we believe the current environment more closely resembles 1995 than 2000.

Taking Nvidia as an example, the stock is currently trading at approximately 25 times forward earnings. This valuation represents the level where shares troughed in July 2022 and October 2023. Three to six months after those troughs, the stock was trading at roughly 37 times forward earnings. Furthermore, Nvidia stock is now trading at its widest ever approximately 40% discount to Broadcom's current 42x forward PE, versus historical ranges of negative 10% to positive 7% discount or premium over the past one to two years.

This valuation dynamic suggests that consensus has already implicitly shifted at least 10+ points of AI market share towards Broadcom for the 2026-2027 timeframe. While this may prove prescient, it also indicates that Nvidia's valuation has room for expansion if the company maintains its market leadership position.

Key Earnings Releases

Several high-profile companies report earnings this week with significant implications for market direction. Broadcom reports on Thursday December 11th, with expectations calling for strong results driven by custom AI accelerators for major hyperscalers. The focus will be on Alphabet's TPUs, which supply chain checks indicate are being revised higher. AI networking checks also continue to show quite positive trends.

Multiple sources expect material near-term upside to estimates. When Broadcom has given positive guidance at earnings in the past, the stock gapped higher 86% of the time, with an average gap of 4.7% and continued gains averaging 1.4% over the subsequent week. The primary risk is sentiment, which remains quite bullish. However, historical data shows that when sentiment was at current levels, the stock was higher three months later 77.6% of the time with average gains of 9.3%.

Ciena reports on Thursday December 11th, providing insight into AI networking demand. After hyperscalers and others have spent heavily to build data centers to house AI servers, they are now investing significantly in networking. Data centers need internal networking for servers to communicate, plus external networking to connect to other data centers and end users. Industry checks suggest Ciena is not only benefiting from strong tailwinds but also appears to be taking market share.

Expectations call for Ciena to raise revenue guidance when it reports. When the company has provided positive guidance in the past, the stock gapped higher 74% of the time with an average gap of 6.5%. The AI networking build-out remains in early stages, suggesting sustained demand ahead.

Campbell's Soup reports on Tuesday December 9th, providing a read on the challenged packaged food sector. The company faces multiple headwinds including higher input costs, a tight consumer market, secular weakness from GLP-1 drugs, and a short-term reduction in SNAP benefits. Data suggests the company was tracking below expectations during the quarter, though there has been modest improvement attributed to easier comparisons in soup and timing-related benefits.

The interesting setup here involves elevated short interest, which has gradually increased to the highest level since 2018. This creates potential for a short squeeze if results come in better than the low expectations. Historically, when Campbell's has reported in-line results and reiterated guidance, the stock gapped higher an average of 2.2% with gains of another 2.2% over the following month, achieving a 70% success rate. However, there's little evidence of a fundamental bottom just yet.

Oil:

Price Action and Market Dynamics

WTI crude closed the week 1.11% higher at $60.18 per barrel, extending gains above the psychologically important $60 level. Markets weighed ongoing peace talks between Russia and Ukraine alongside a simmering conflict between Venezuela and the United States. General risk-on investor appetite and optimism over another Fed interest rate cut this week both provided support for prices.

The advance came as President Trump indicated the U.S. would start taking action to stop Venezuelan drug traffickers on land "very soon." Such a move could put at risk Venezuela's 1.1 million barrels per day of crude oil production, which goes mostly to China. While this geopolitical premium provided some support, fundamental dynamics in oil markets remain largely unchanged on a week-over-week basis.

Supply and Demand Considerations

The fundamental backdrop for crude oil remains challenged by rising supply and mixed demand signals. While the Fed rate cut typically provides support for commodities, the bearish forces currently impacting crude markets appear stronger. Markets are also processing the phase-out of Russian energy from European markets, with European countries confirming the complete elimination of Russian LNG by the end of 2027.

US LNG exports demonstrated robust growth, rising 40% annually in November to 10.7 million tonnes. This increase occurred even as producers continued increasing output, suggesting strong global demand for American energy exports. However, this supply growth adds to the overall glut in energy markets.

The Trump Administration has made lower energy prices a clear economic priority. This political backdrop creates an implicit ceiling on crude oil prices, as the administration appears willing to encourage production increases and may resist any meaningful rally in energy markets. This represents a structural headwind that could cap upside attempts for an extended period.

Technical Outlook

WTI crude has been trading in a clear range of $55 to $62 over the last couple of months, creating highly tradable technical swings. The commodity fell into $57 and found support from its daily bottom Bollinger Band in late November. Since then, the daily RSI has rebounded off approximately 40 support, moved into approximately 55 last week, and price action reclaimed $60 resistance on December 5th.

The daily top Bollinger Band has begun shifting higher again, now at $60.90, while the daily bottom Bollinger Band has flattened out at $57.60. This pattern is consistent with momentum shifting after reaching the bottom end of the technical range. Sustained momentum this week should push oil prices toward $62, which represents the top end of the established trading range.

We believe breakouts in energy prices will be contained over the long-term as the Trump Administration has made lower prices a clear policy priority. Therefore, we maintain a tactical approach of trading the range rather than anticipating a sustained breakout. The technical setup favors further upside in the near-term toward $62, at which point we may elect to turn bearish again.

Metals:

Gold Market Overview

Gold prices closed the week 0.52% lower at $4,225 per ounce, consolidating near record highs as odds of a 25 basis point interest rate cut on Wednesday reached 87% and the US Dollar Index extended its two-week decline. Despite the modest pullback, gold remains firmly supported above the critical $4,000 psychological level and continues to benefit from an exceptionally strong fundamental backdrop.

Silver prices surged to a new record high above $59 per ounce, putting the metal on track for its first 100%+ annual gain since 1979. This exceptional performance in silver reinforces the broader precious metals bull market and suggests continued strong demand for inflation hedges and safe haven assets.

The US Dollar Index declined below 99 support last week, falling into the 98.80 daily bottom Bollinger Band where momentum began to stall. However, the daily RSI remains at approximately 42 with room for further downside. The broader trend in the Dollar Index continues to suggest a drop into 96 is possible, which would provide additional support for gold prices.

Fundamental Support Factors

The fundamental case for gold ownership remains robust across multiple dimensions. Central bank demand continues at historically elevated levels as gold has solidified itself as the dominant global safe haven asset. Physical gold demand remained strong throughout the week, and central bank purchases continue to hit multi-decade highs.

Geopolitical tensions persist globally, providing ongoing support for safe haven demand. The ongoing government shutdown creates uncertainty about economic data and fiscal policy, both traditionally supportive factors for gold. Real interest rates remain in negative territory despite recent nominal rate increases, which continues to make gold attractive relative to fixed income alternatives.

The recent strength in the US Dollar, while creating near-term pressure on gold prices, appears unsustainable from a technical perspective. The Dollar Index reached a daily RSI of approximately 67 and crossed above its daily top Bollinger Band at 99.67, indicating overbought conditions. Without sufficient fundamental support for a sustained Dollar rally, we expect this strength to prove temporary, removing a key headwind for gold.

Technical Analysis and Outlook

Gold's technical correction has actually improved the sustainability of the uptrend. The metal attempted two breaks above $4,300 last week, on December 1st and December 5th, both of which failed to hold. However, these failed breakout attempts have allowed crucial technical indicators to reset to healthier levels rather than representing a change in trend.

The daily top and bottom Bollinger Bands have shifted up to $4,307 and $3,995 respectively, indicating the entire trading range continues to move higher. The daily RSI has retreated into approximately 60 uptrend support, a level that has historically provided strong buying interest and preceded further gains. This RSI level provides substantial room for renewed upside momentum.

The intra-week pullback into $4,194 on December 2nd appears to have formed another higher low in the broader uptrend stemming from the October 28th low of $3,901. This pattern of higher highs and higher lows confirms the structural bull market remains intact. The daily bottom Bollinger Band at $3,995 represents its highest level on record, suggesting that long-term support levels continue to rise with price.

We expect a sustained move above the $4,300 level to open the path toward new record highs. The combination of improved technical positioning following the recent consolidation, strong fundamental support from multiple sources, and the likely temporary nature of Dollar strength creates a compelling setup for renewed gains in precious metals. Our target of $4,400 represents a reasonable near-term objective based on the current momentum and fundamental backdrop.

Stock Picks

Broadcom Corporation (AVGO)

Company Overview

Broadcom represents a compelling opportunity in the AI infrastructure space as the company gains significant market share with custom AI chips for major hyperscalers. The company reports fourth quarter 2025 earnings on Thursday, December 11th after market close. Consensus expectations call for earnings per share around the high end of management's previously provided guidance range.

While Nvidia leads in AI servers overall, Broadcom is gaining substantial market share among the biggest AI spenders through custom AI accelerators. Broadcom makes custom AI accelerators for Meta, ByteDance, and Alphabet. Additionally, OpenAI will become a customer in 2026, with other companies in the pipeline that Broadcom believes will be eventual customers.

Growth Catalysts and Market Opportunity

The focus this quarter centers on Alphabet's TPUs (Tensor Processing Units). Supply chain checks point to the TPU supply chain being revised higher, suggesting stronger than expected demand. AI networking checks also continue to show quite positive trends. Multiple sources expect this quarter to show material near-term upside to current estimates.

The AI infrastructure market continues to expand rapidly as hyperscale cloud providers increase their capital expenditure commitments. This creates sustained demand for Broadcom's custom AI solutions, networking products, and connectivity components. The company's ability to provide custom solutions tailored to specific hyperscaler requirements differentiates it from commodity semiconductor providers.

Technical Setup

Broadcom stock currently displays favorable technical characteristics heading into earnings. The stock attempted an early rebound last week but failed to hold gains. However, the daily RSI has held approximately 37 trendline support, suggesting the recent weakness represents consolidation rather than a change in trend.

Earnings Track Record

Broadcom has an excellent track record of positive market reactions to strong earnings. When the company has given positive guidance at earnings over the past several years, the stock gapped higher 86% of the time (25 out of 29 occurrences). On average, the stock gapped higher by 4.7% and continued higher by an average of 1.4% over the subsequent week.

Risk Factors and Sentiment Analysis

The primary risk heading into earnings is elevated sentiment. Bullish positioning has been quite high for the past six months and remains at elevated levels currently. It was also around current levels this time last year, and it proved to be a headwind for the stock until sentiment rolled over and pulled back.

However, historical data provides some reassurance. When sentiment was at current levels in the past, the stock was higher three months later 77.6% of the time with average gains of 9.3%. More significantly, while sentiment remains high, it has dropped modestly during the quarter. This scenario, though it hasn't happened often, has historically been quite positive. When it has occurred, shares of Broadcom were higher by an average of 22.3% three months later and were higher 98.5% of the time.

Investment Outlook

We believe Broadcom is well-positioned for a strong earnings report and positive guidance that could drive the stock significantly higher. The combination of strong fundamental momentum from AI infrastructure spending, supply chain data pointing to upside surprises, favorable historical earnings patterns, and an improving technical setup creates an attractive risk-reward profile.

The company's strategic position providing custom AI solutions to the world's largest technology companies provides visibility into sustained demand and market share gains. While elevated sentiment presents some risk, the historical pattern suggests this is manageable, particularly given the modest decline in sentiment during the quarter.Closing

Closing:

Current Portfolio Positioning

Our portfolio maintains a net long position in the overall stock market, reflecting our constructive outlook for equities in the current environment. The combination of strong corporate earnings trends, accommodative Federal Reserve policy despite recent hawkish rhetoric, and robust technology sector capital expenditure plans all support further upside in major indices.

Within the equity allocation, we hold a concentrated position in a single name: Nvidia. This holding reflects our conviction in the sustainability of AI infrastructure spending and Nvidia's dominant market position in this multi-year capital expenditure cycle. We have not made any changes to this position during the past week.

The recent technical consolidation in Nvidia and other large-cap technology stocks appears healthy after the strong run from earlier in the year. We view any near-term weakness as an opportunity to potentially add to the position rather than a signal to reduce exposure, provided that the fundamental thesis remains intact based on continued capital expenditure commitments from hyperscale cloud providers.

Strategic Rationale

The investment thesis for our AI infrastructure position has been significantly reinforced by recent earnings commentary from major cloud providers and semiconductor companies. The scale of announced capital spending continues to exceed expectations and shows no signs of moderating. This massive and growing capital deployment creates a highly favorable backdrop for companies at the center of the AI buildout.

Commentary from companies across the AI supply chain suggests we are still in relatively early stages of this infrastructure buildout. Management teams at semiconductor and networking equipment companies are providing guidance for accelerating growth rates extending into 2027 and 2028. Until we see signs of order cancellations or spending pullbacks, the fundamental case for maintaining exposure remains strong.

Trading Strategy and Risk Management

For the S&P 500, we maintain a bullish stance with a target of 7,000 and a stop-loss at 6,700. The recent pullback and consolidation created a favorable entry point, with key technical support levels holding and momentum indicators resetting to healthier levels. We watch 6,900 as the near-term technical pivot that should open the path to new all-time highs. We continue to view any headline-driven weakness as temporary noise and opportunity rather than fundamental threats to the equity bull market.

In commodities, we hold a tactical bullish position on WTI crude oil with a $62 target and $54 stop-loss. The fundamental backdrop has shifted slightly back in favor of bulls as prices rebounded off the bottom end of their established $55 to $62 trading range. We maintain this tactical approach given the Trump Administration's clear policy priority of keeping energy prices contained.

For precious metals, we remain bullish on gold with a $4,400 target and $3,850 stop-loss. The recent technical correction has improved the sustainability of the uptrend by allowing indicators to reset. The fundamental case remains historically strong as another Fed rate cut appears certain, the Dollar Index has extended its decline, and safe haven demand continues at elevated levels.

For fixed income, we hold a bullish position on the iShares 20+ Year Treasury Bond ETF with a $93 target and $85 stop-loss. Despite recent volatility in yields, we expect rates to decline as markets process continued Fed rate cuts and the ongoing government shutdown forces the Fed to maintain its accommodative bias. The technical picture suggests TLT is positioned at the bottom end of its channel and oversold, setting up for a bounce toward $89.50.

Market Outlook Summary

Overall, our positioning reflects confidence in the continuation of the equity bull market, supported by strong corporate fundamentals, accommodative monetary policy, and a constructive technical setup following recent consolidation. The week ahead brings the crucial Fed policy decision, which we expect will reinforce our bullish positioning through another rate cut justified by labor market concerns.

We remain focused on the AI infrastructure theme within equities while maintaining tactical positions in other asset classes to capture what we view as favorable risk-reward opportunities. The combination of historic jobless claims data, strong corporate guidance trends, and technical indicators all resetting to healthier levels suggests the path of least resistance for equities remains higher in the near term.

As we have emphasized throughout this year, the Fed appears committed to cutting interest rates to support the labor market even while inflation runs moderately above target. This creates a powerful tailwind for asset prices and reinforces our core view: own assets or be left behind. Wednesday's Fed decision should provide another confirmation of this dynamic and potentially catalyze the next leg higher in equity markets.

What's Next?

We want to hear from you. Hit reply and tell us: What's your biggest investment challenge right now?

Whether it's timing entries, managing risk, or identifying the next major opportunity—we read every response and use your feedback to make our research even more valuable.

Here's to your financial success,

Sincerely,

7AM Team

IMPORTANT DISCLAIMER

This report represents analysis and opinion rather than investment advice or recommendations. All views expressed reflect our current thinking and may change as new information becomes available. Past performance does not guarantee future results.

Readers should conduct their own research and consult with qualified financial advisors before making investment decisions. Market conditions can change rapidly, and positions discussed may not be suitable for all investors depending on individual circumstances, risk tolerance, and investment objectives.

The information provided is believed to be accurate but is not guaranteed. We do not warrant the completeness or timeliness of information presented. Investing involves risk including possible loss of principal. There is no assurance that any investment strategy will achieve its objectives.