Executive Summery:

• S&P 500 drops 1.95% to 6,603 as technology stocks face most volatile week since April following Nvidia earnings reaction and crypto selloff

• Q3 2025 earnings season concludes strong with 83% of S&P 500 companies beating expectations and blended growth rate reaching 13.4%

• Federal Reserve maintains expectation for December rate cut despite delayed September jobs data showing mixed employment signals

• US proposes peace deal between Russia and Ukraine creating uncertainty in energy markets as oil prices decline 3.33%

• Technology sector sentiment reaches lowest levels since April while earnings continue trending higher, creating potential opportunity

Previous Week:

Equity Market Performance

The S&P 500 experienced its most volatile week since April, closing down 1.95% at 6,603. Markets reacted sharply to Nvidia's earnings report, which despite exceeding expectations, triggered unusual selling pressure. The index gapped higher initially following the results but reversed dramatically, closing lower on the day. This pattern of opening strength followed by intraday weakness marked a significant shift in market behavior.

The technical picture showed concerning developments. The S&P 500 decline accelerated during intraday trading after reversing below 6,700 support. Markets experienced a sharp flush down to 6,534, which was retested at 6,522, resulting in two daily crosses below the 6,560 bottom Bollinger Band. The daily RSI bounced off approximately 35 support before stabilizing on Friday.

Market participants are increasingly moving as a collective unit. When declines begin, investors rush to exit positions believing corrections are imminent. Conversely, when rallies commence, capital rotates back into favored sectors rapidly. This herd mentality creates amplified volatility in both directions, making technical levels more critical for trading decisions.

Corporate Earnings Season

Third quarter 2025 earnings season concluded with impressive results. With 95% of S&P 500 companies now reported, 83% exceeded earnings expectations while 76% surpassed revenue forecasts. The blended earnings growth rate finished at 13.4%, substantially above initial expectations of 7.9%.

Looking forward to Q4 2025, corporate guidance presents a mixed picture. Forty-three companies issued negative earnings guidance compared to 34 providing positive outlook. This ratio suggests increased caution among management teams regarding near-term business conditions.

Nvidia delivered record-setting results, exceeding both revenue and earnings expectations while providing guidance above consensus estimates. However, the stock initially jumped 5% before reversing to close down 3.2%. This rare price action has occurred only four times previously, with mixed outcomes for both the stock and broader market in subsequent months.

Sector performance revealed stark divergence. Technology stocks, despite strong earnings momentum, suffered from deteriorating sentiment as investors questioned valuations. Meanwhile, earnings in the sector continue trending higher, creating a potential disconnect between fundamentals and market psychology.

Employment and Economic Data

The delayed September jobs report finally released, showing the US economy added 119,000 jobs, well above expectations of 50,000. However, the unemployment rate increased from 4.3% to 4.4%, reaching the highest level since October 2021. This mixed data creates uncertainty for Federal Reserve policy decisions.

The ongoing data blackout continues to affect market visibility. October and November employment data will not be announced until December 16th, while November CPI inflation data is delayed until December 18th. This means the Federal Reserve's December 10th meeting will occur without two critical data releases typically used for policy decisions.

Various Federal Reserve members expressed divergent views last week. Some advocated for pausing rate cuts while others suggested continuing with 25 basis point reductions or even larger cuts. Currently, markets price in a 74% probability of a December rate cut, up from below 50% earlier in the week. The data void forces the Fed to rely more heavily on stated priorities around labor market support.

Upcoming Week:

Market Outlook and Technical Setup

The technical setup shows the S&P 500 has experienced a healthy technical correction. The index tested support zones between 6,500-6,550 twice, holding critical levels. The daily bottom Bollinger Band was crossed at 6,560, and the RSI bounced off approximately 35 support, both historically significant technical indicators.

We believe this represents a textbook correction within an ongoing uptrend. Friday's rebound suggests buyers are stepping in at these lower levels. The rapid decline created oversold conditions that typically precede rallies. With technology earnings fundamentally strong and the Federal Reserve maintaining accommodative policy, conditions support renewed upside.

The 6,735 level, or $671 for the S&P 500 SPDR, represents key resistance. The market has experienced two significant selloffs from this line. Until the index can break and hold above this level, it should be viewed as overhead resistance requiring careful attention. A sustained move above 6,735 would signal resumption of the prior uptrend with potential toward 7,000.

Federal Reserve Policy Path

The Federal Reserve faces a complex decision at the December 10th meeting. The delayed economic data creates uncertainty, but several factors suggest another 25 basis point rate cut remains likely. The ongoing data blackout forces reliance on the Fed's stated commitment to supporting labor market conditions.

Additionally, the Fed announced ending quantitative tightening beginning December 1st, signaling broader commitment to accommodative financial conditions. Internal committee dynamics also suggest dovish bias, with dissent at the November meeting coming from a member advocating for a larger 50 basis point cut rather than holding rates steady.

Treasury yields retreated last week despite the mixed employment data, with the ten-year note falling 9 basis points to 4.06%. This movement suggests bond markets are pricing in continued rate cuts and viewing the economic data through a dovish lens. We expect yields to continue declining toward 4.00% as the December meeting approaches.

Key Earnings Releases

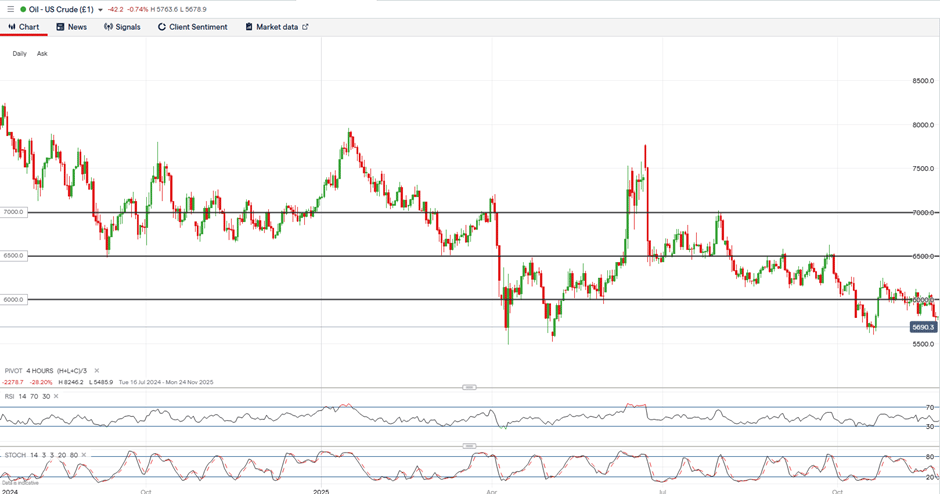

This week features important earnings releases primarily in Technology and Retail sectors. Workday reports Tuesday with sentiment near multi-year lows despite the company historically performing well under similar conditions. Short interest has reached levels not seen since 2019, creating potential for positive surprises if results exceed expectations.

Zscaler reports Tuesday after experiencing a pullback from recent highs. The stock has established a trading range between $265 and $315. Expectations remain moderately positive, with checks showing strong annual recurring revenue trends despite some seasonal slowness. A break outside this range could signal the direction for secondary moves.

MongoDB reports Monday December 1st, approximately one week earlier than typical timing. This accelerated schedule, despite CEO transition announcements, suggests confidence in results. The company has already indicated expectations to exceed the high end of guidance ranges for both earnings and revenue, setting up potential for further upside surprises.

NetApp reports Tuesday with both sentiment and short interest at multi-year extremes. This combination creates potential for significant moves if results prove expectations wrong. The stock has historically performed well when sentiment reaches current depressed levels, with gains averaging 12.0% over subsequent three-month periods.

Oil:

Price Action and Market Dynamics

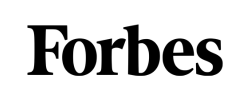

WTI crude declined 3.33% to close at $57.97 per barrel as markets reacted to news of potential peace negotiations between Russia and Ukraine. The US reportedly proposed a plan requiring Ukraine to cede territory including Crimea, Luhansk, and Donetsk while pledging not to join NATO. President Trump indicated he wants Ukraine to accept the deal by Thursday.

The proposed peace agreement created immediate pressure on oil prices as markets anticipated reduced geopolitical risk premiums. Prices fell back into the bottom end of their recent range, nearing $57.00 during intraday trading on Friday. This level represents a critical support zone that has held multiple times in recent months.

From a technical perspective, last week's decline pushed oil into relatively oversold territory. The commodity experienced a sharp cross below the $58.10 daily bottom Bollinger Band aligned with a test of approximately 38 trendline support in the daily RSI. These conditions typically precede at least short-term stabilization or bounces.

Supply and Demand Factors

The fundamental backdrop for crude oil remains moderately weak. Broader risky assets declined alongside the AI trade pullback, creating correlated selling pressure across commodity markets. Volatility has weighed on risk appetite generally, affecting energy prices despite supportive factors like Federal Reserve rate cuts.

Oil prices are approaching the bottom end of their recent range between $55.50 and $62.00. The peace deal developments represent the primary driver currently, though production levels and demand signals continue influencing the market. President Trump's ongoing advocacy for lower energy prices creates an implicit ceiling limiting upside potential.

We have moved to a neutral stance on crude oil after closing our previous bearish position for gains. The technical picture appears slightly oversold near the bottom of the range, but fundamental factors remain challenging. We will reassess the setup as price action develops through the week, with $55.50 representing the bottom and $62.00 the top of the current trading range.

Natural Gas

Natural gas prices ended the week 0.62% higher at $4.74, with December futures briefly falling below $4.25 before reversing. Along with broader market volatility, natural gas experienced sharp intraday swings as investors reacted to inventory data and weather forecasts.

The EIA reported a 14 Bcf withdrawal from natural gas inventories, stronger than expected 12 Bcf and well below the five-year average build of 12 Bcf. Storage now stands 3.8% above the five-year average and 0.6% below last year's levels. Dry gas production remains elevated at 110.1 Bcf per day, up 7.6% year-over-year, making weather the primary driver of near-term price action.

Weather models shifted colder for late November, but near-term demand remains weak. Expectations of a colder December are largely priced into current levels. The forward curve shows significant contango, with January futures trading approximately 5% above December and nearly 10% above February. We expect this gap to fill to the downside.

Natural gas rallied into $4.80 resistance for three consecutive sessions, with all attempts rejected. Technical indicators show a move back into approximately 62 uptrend support in the daily RSI with Bollinger Bands shifting higher. However, the top end of channel resistance was rejected at $4.90, and we expect a corrective move into the bottom of the channel at $4.30. We maintain a bearish stance with a $4.30 target and $5.00 stop-loss.

Metals:

Gold Market Overview

Gold prices closed the week virtually unchanged at $4,080 per ounce, down just 0.10%. Despite Bitcoin extending declines of over 35% from record highs and broader asset classes selling off sharply, gold demonstrated remarkable resilience. This relative strength during market turmoil reinforces gold's status as the preferred global safe haven asset.

Gold reacted to the delayed September jobs report, which showed employment gains above expectations but rising unemployment. As rate cut expectations moderated, the US Dollar Index rebounded above 100.00, reaching the November 5th high of 100.36. However, gold held support levels despite typical headwinds from dollar strength.

Fundamental Support Factors

The fundamental case for gold ownership remains robust. Central bank purchases continue at historically elevated levels, providing consistent bid support. Geopolitical tensions persist globally, from potential peace negotiations in Ukraine to ongoing Middle East conflicts. Real interest rates remain in negative territory despite nominal rate increases, creating favorable conditions for non-yielding assets.

Market volatility in equity markets has increased dramatically, driving demand for safe haven assets. Gold held strong while almost all other asset classes declined last week. This divergent performance signals that gold continues serving its traditional role as portfolio insurance during uncertain periods.

The dollar's recent strength appears technically unsustainable. The Dollar Index reached a daily RSI of approximately 67 while crossing above its daily top Bollinger Band at 99.67, indicating overbought conditions. Without sufficient fundamental catalysts for sustained dollar rallies, we expect this strength to prove temporary, removing a key headwind for gold prices.

Technical Analysis and Outlook

Gold traded in a relatively tight range last week despite multiple tests of support levels. The metal found buyers at $4,000 and $4,050, with the daily RSI holding steady above approximately 50 support before edging higher. The daily top and bottom Bollinger Bands remained unchanged at $4,190 and $3,920 respectively, indicating current technical consolidation.

We believe consolidation in the $4,000 to $4,100 zone is setting up for a breakout above the November 13th high of $4,250. The ability of gold to hold support levels amid widespread selling across other markets demonstrates underlying strength. Once the current consolidation phase concludes, we expect renewed momentum toward new all-time highs.

The combination of strong fundamental support, resilient price action during market stress, and improving technical positioning creates a compelling case for higher gold prices. We maintain our bullish stance with a $4,400 target and $3,850 stop-loss, viewing any near-term weakness as attractive entry opportunities for additional exposure to precious metals.

Stock Picks

Workday, Inc. (WDAY) - Compelling Setup

Workday reports third quarter fiscal 2026 earnings on Tuesday, November 25th after market close. The company operates in enterprise cloud applications for finance and human resources, representing a critical sector of business technology spending. Consensus expectations call for earnings of $2.17 per share on revenue of $2.41 billion.

Technical and Sentiment Setup

Sentiment toward Workday has reached extreme pessimism. Current bearish sentiment stands at levels not seen since 2019, with 39.1% of investors holding negative views. Historically, when sentiment reaches these levels, the stock has been higher three months later 77% of the time with average gains of 12.0%.

Short interest has climbed to multi-year highs, also not witnessed since 2019. This elevated short position creates potential for significant upward pressure if results exceed expectations. When purchased at previous instances of similar short interest levels and held for three months, investors were profitable 77% of the time with average gains of 6.6%.

The stock recently pulled back from higher levels but has shown signs of stabilizing. The daily technical indicators demonstrate room for upside momentum following the recent consolidation. This setup creates asymmetric risk-reward potential, where positive results could trigger both fundamental buying and short covering.

Fundamental Outlook

Despite deteriorating sentiment, Technology sector earnings continue trending higher. The disconnect between improving fundamentals and declining investor confidence often presents opportunities. Workday participates in secular growth trends around digital transformation and cloud adoption that remain intact regardless of near-term market volatility.

Expectations for the quarter appear generally in line with recent trends. Some checks suggest potential for meeting or slightly exceeding guidance. The combination of depressed expectations, negative sentiment, and elevated short interest means even inline results could trigger positive reactions. Strong results with improved outlook would likely generate more dramatic upside.

Given the combination of extreme negative sentiment, elevated short interest, improving earnings trends in the Technology sector, and constructive technical setup, we believe Workday represents an attractive opportunity ahead of Tuesday's earnings release. The risk-reward profile favors those willing to take positions before results, with potential for significant moves if the company delivers positive surprises on either earnings or guidance.

Closing:

Current Portfolio Positioning

Our current portfolio maintains a neutral position in the overall stock market. We transitioned from our previous net long stance following last week's volatility and technical breakdown. The dramatic reversal in market leadership stocks, particularly Nvidia's unusual price action despite strong results, suggests increased caution is warranted near term.

Within the equity portfolio, we hold a long position in MongoDB and maintain a small position in Nvidia. MongoDB represents our conviction in database technologies benefiting from AI application development. The company's accelerated earnings date suggests confidence in results, and we view the recent pullback as a potential entry opportunity before the December 1st report.

Our Nvidia position has been reduced to a small holding after experiencing the sharp reversal following earnings. While the fundamental AI story remains intact with accelerating growth and expanding margins, the technical price action raises concerns about near-term momentum. We maintain exposure to participate in potential recovery but have reduced size to manage risk.

Strategic Rationale

The thesis for AI infrastructure spending remains fundamentally sound. Major technology companies continue committing massive capital expenditure to building out AI capabilities. However, the unusual market reaction to Nvidia's strong results suggests investors may be growing cautious about valuations or concerned about near-term oversaturation.

We are monitoring the $180 level for Nvidia closely. As a clear market leader, if Nvidia cannot hold this support level, it likely signals broader weakness ahead for technology and the overall market. Conversely, a successful defense of $180 followed by recapture of $200 would indicate the correction was merely technical rather than fundamental.

The recent volatility appears to be a technical correction within the context of an ongoing bull market. However, the intensity of the selloff and the herd-like behavior of market participants warrants respect. We prefer waiting for clearer technical signals before adding significant exposure, rather than attempting to catch falling momentum.

What's Next?

We want to hear from you. Hit reply and tell us: What's your biggest investment challenge right now?

Whether it's timing entries, managing risk, or identifying the next major opportunity—we read every response and use your feedback to make our research even more valuable.

Here's to your financial success,

Sincerely,

7AM Team

IMPORTANT DISCLAIMER

This report represents analysis and opinion rather than investment advice or recommendations. All views expressed reflect our current thinking and may change as new information becomes available. Past performance does not guarantee future results.

Readers should conduct their own research and consult with qualified financial advisors before making investment decisions. Market conditions can change rapidly, and positions discussed may not be suitable for all investors depending on individual circumstances, risk tolerance, and investment objectives.

The information provided is believed to be accurate but is not guaranteed. We do not warrant the completeness or timeliness of information presented. Investing involves risk including possible loss of principal. There is no assurance that any investment strategy will achieve its objectives.